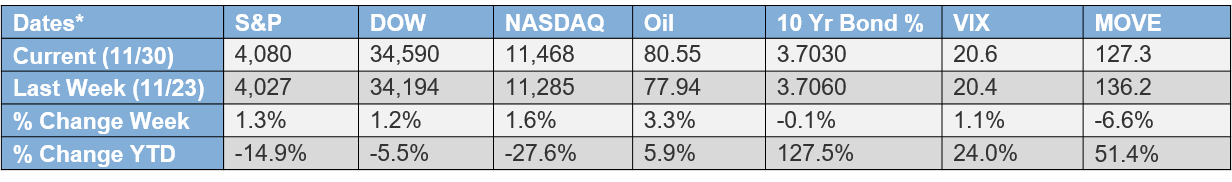

Welcome back from Thanksgiving and I hope you all had a nice break with your family and friends. November 2022 is in the books and wow what a year it has been! The market actually closed out November on a strong note with all major indices posting strong gains as Chairman Powell set the tone for optimism when he announced on Wednesday that the pace of rate hikes could come down and might start in December (the Dow was up 737 points or 2.2%, the S&P was up 3%, and the Nasdaq was up 4.4%). That brought a welcome relief, but the question still remains how much longer will the Fed keep raising rates?

In other news this week, we got more economic data with consumer spending up a strong 0.8% in October, the infamous PCE inflation report – the Fed’s preferred metric for inflation – rose 0.3% in October and was up 6% y/y, and on the jobs front, unemployment claims fell 16,000 from last week to 225,000 and continuing claims rose 57,000 to 1.608 million. And on the housing front pending home sales declined 4.6% in October after a big drop in September so we will probably see another drop in November. That is all a lot to digest but in a nutshell, we continue to see a strong consumer and with preliminary reports coming out of Black Friday showing record levels of sales at $9 billion, that trend does not appear to be stopping anytime soon. Then on inflation yes it’s nice to see it coming down but we are still at levels the Fed will have to address by staying aggressive with rate hikes. And then with jobs, we still remain in a tight labor market where demand is greater than supply which is also driving that wage inflation number up.

Something has to give here with the market wanting to see economic growth but with higher costs across the board at the same time. Which is making the Fed stay aggressive. As a result, it makes a lot of sense for us to see the economy slow down as we enter Q123. Because the Fed continues to hike as inflation stays persistently high. This will lead to higher borrowing costs across the board which hinders the ability for companies to grow which in turn takes away from their bottom line, i.e. earnings. Which ultimately drives the market. Because history shows the market trades on earnings. And with P/E trading at roughly fair value in the 17 range these days, if the “E” goes down then the only way for the market to stay at fair value is for the “P” to go down too. This is a pretty high level and simple way of saying what we all know could happen if the Fed continues to tighten into the new year, which we know they will. So, Wednesday’s rally may be a little premature and we could see more volatility and downside pressure ahead. Especially as companies revisit their operations and forecast out on both the revenue and expense side as we head into 2023. Because both sides of the equation are being affected by inflation. It just depends which companies can hold or improve their margins (which improves earnings) and which ones can’t (which don’t). It’s been quite a balancing act but again something’s got to give if we are at fair value right now and expect a slowdown in the economy.

As a result, terms like “earnings recession” or “economic recession” or “hard/soft landing” are what’s on many investors’ minds these days. People are asking which one will it be or will any of this actually happen? There is no right answer at this point. But there is plenty of data to rest your hat on. For example, the Leading Economic Indicators are a very good predictor of recessions and it is clearly showing signs. Yet, manufacturing is a big component to the LEIs and in yesterday’s ISM Manufacturing Index report, although it posted a 49 which indicates contraction territory, it was interesting to see that there were very few comments about supply chain in the survey responses, which has been such a downer on the economy since COVID hit. It was also interesting to see the production index remains in expansion (at 51.5) which is giving US factories time to catch up on pipeline orders they already have. Example: check out the backlog index result for November which is at 40 and the lowest it has been since COVID. Which is a good sign. I’ve also been thinking if supply chain can work itself out then that will turn the manufacturing component around in the LEIs and maybe, just maybe, they will turn out of that recessionary signal. Or maybe it will be a “mild recession” which is another one of those terms being tossed around out there.

Regardless of whether you think we are heading for an “economic recession” or an “earnings recession” or a “full recession” or a “mild recession”, this environment we are in right now truly has many, many moving parts. Even globally, for example China in Zero Covid (yet they are now signaling they might come out of it and maybe treat it like the flu). And the war in Ukraine still continues. Which we are heading into the winter heating season and Putin will probably play games with their energy needs over there. And of course, the inflation dilemma here in the US. Not to mention the FTX saga too. The point is there is still quite a bit of uncertainty out there and that simply leads to volatility. Which we have been planning for all year and allocating accordingly for in the models.

Speaking of which, I’ll close this week’s note with an analogy from the holiday decorating I was doing at our house here in PA last weekend. I found myself out stringing Christmas lights around the various trees and bushes in our yard. One of the strings I was working with had a broken bulb and when I went to unscrew it, the filaments touched and next thing I knew the whole string of lights went out. I thought to myself oh no! I hope I didn’t just burn out the whole string of lights! I checked everything else and then I remembered usually there is a fuse in the plug. So, I checked it and yes there it was. I changed it out and voila all the lights came back on. What a relief! I finished the tree I was working on and kept going to finish out the day decorating and now our house looks great.

Of course, that got me thinking about investing and what we do in the GVA models, and it dawned upon me that that little fuse did so much to protect the entire string of lights. And gave me a big relief when all the other lights came back on. So, if you think about that in the context of asset allocation, diversification, and portfolio management, it’s actually kind of the same thing as to how we manage risk. Because we introduce fail-safes and defensive measures in portfolios to do just that – to help diversify away risk and give investors relief when the unexpected happens. Or even if there is just too much uncertainty out there. Like there is right now. Just like that little fuse protected the whole string of lights. This is what we have been doing all year in the midst of this very challenging environment we’ve been in where we have seen record declines on both sides of the market in equity and fixed income. For example, we introduced alternatives for the first time this year which have provided nice ballast to our fixed income holdings and on the equity side we’ve been overweight to the energy sector which has really been the only sector that has consistently shown strength all year, and we’ve peppered in selective overweights to defensive ideas in healthcare and staples.

The point is when we invest, we do so just like that string of Christmas lights. That together shine bright and bring us joy. Yet at the same time, we incorporate fail-safe defensive mechanisms in the portfolios to help offset the unexpected and/or added volatility. So, when you are out decorating this holiday season or driving around looking at all the nice lights out there, think about the backups and fail-safes in place that will keep those lights on and shining colorful and bright! And make sure you have extra fuses!

Have a great weekend and let’s see what the market brings us on Monday.

*all data sourced from Yahoo Finance as of the close on the date indicated.

Disclosures

- The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

- There is no assurance that any products or strategies discussed are suitable for all investors or will yield positive outcomes. Any economic forecasts set forth in this note may not develop as predicted.

- All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Alternative investments may not be suitable for all investors and should be considered as an investment for the risk capital portion of the investor’s portfolio. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

- Securities offered through LPL Financial, member FINRA/SIPC. Investment advice offered through Great Valley Advisor Group, a registered investment advisor and separate entity from LPL Financial.

Tracking# 1-05349759