Summary

- It has been a recently tough stretch for traditional asset allocation strategies.

- Both stocks and bonds plunged sharply to the downside since late 2021.

- The economic and market environment is increasingly returning toward conditions that support bonds once again providing a diversification benefit relative to stocks.

It has been a recently tough stretch for traditional asset allocation strategies. Prior to the start of last year, an investor with a long-term time horizon seeking to manage risk in the short run could capture the appreciation potential of stocks while offsetting the potential downside by blending in a meaningful allocation to bonds. While such an approach had served investors well for decades, the diversification benefits from owning both stocks and bonds have gone out the window since late 2021. Fortunately, it appears we are increasingly returning to an environment where stocks and bonds are set to resume going their separate ways to the benefit of diversification seeking investors.

Strange bedfellows. While the conditions for such an episode had already been brewing for several months prior, the trouble for investors got underway in earnest starting in late 2021. Up to that point, stocks as measured by the S&P 500 had been soaring to the upside on the rocket fuel of Fed stimulus in response to the COVID crisis. At the same time, bonds were holding their own following a dramatic surge in 2020 as short-term interest rates fell back to 0%. But as we moved through 2021, the long dormant inflation beast was increasingly stirring. By the end of 2021, inflation was suddenly surging past 5%. For the first time since the early 1980s, investors were confronted with a major inflation problem that was not going away.

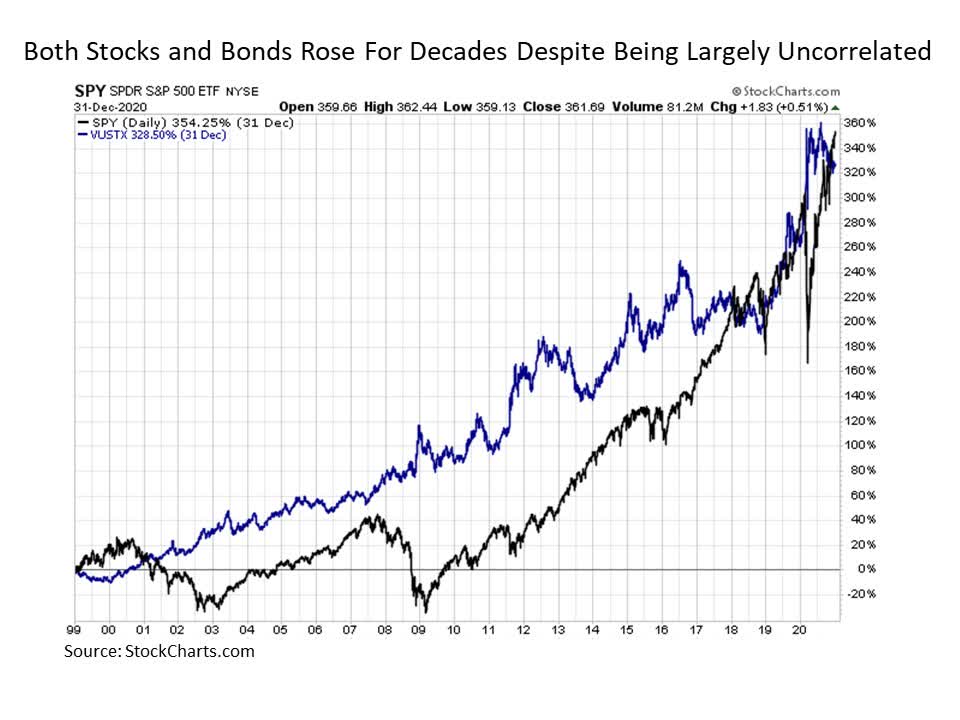

This inflation outbreak presented a problem for both stocks and bonds. Historically, the correlation of returns between U.S. stocks and long-term U.S. Treasuries has been around -0.11. On a scale from -1.00 to 0.00 to +1.00, this represented “very low negative” correlation teetering on the brink of being “uncorrelated”. In other words, stocks and bonds generally move in their own direction on any given trading day, which enabled both stocks and bonds to rise over long-term periods of time. This is shown in the chart below for the period from 1999 to 2020 where stocks and long-term U.S. Treasuries generated comparably positive cumulative returns despite travelling their own total return path at any point in time along the way.

More significantly, during periods when stocks were steadily falling, a time when investors want the diversification benefit of bonds to kick in the most, the correlation between stocks and bonds as measured by long-term U.S. Treasuries shifted to a measurable negative correlation of -0.48. Put more simply, during periods when stocks were steadily falling, bonds were typically rising.

This all worked beautifully for the investor diversifying with stocks and bonds until the end of 2021. Since that time, the correlation of returns between stocks and long-term U.S. Treasuries suddenly became a meaningfully positive +0.60. In short, the diversification benefit completely evaporated with stocks on the S&P 500 falling as much as -27% peak to trough with long-term U.S. Treasuries performing even worse over the same time period.

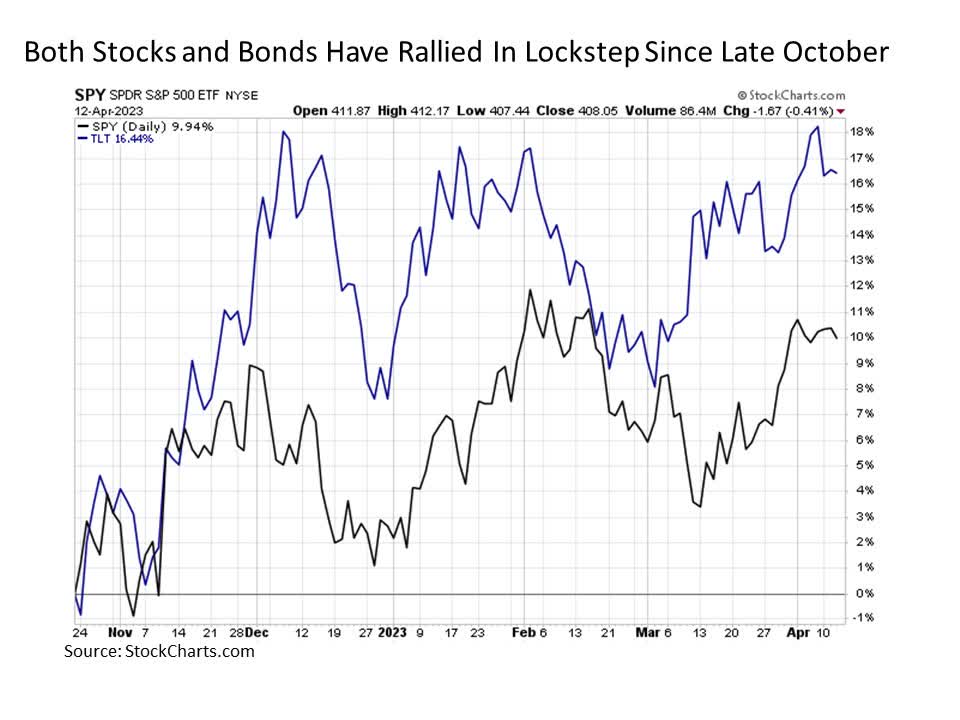

The return of diversification. It has been difficult to discern so far, but broader economic and market conditions are supporting a more favorable environment for bonds to provide diversification for stocks. Since late October 2022, both stocks and long-term U.S. Treasuries have rallied strongly as shown in the chart below.

But as we look forward to the rest of 2023 and into 2024, a few key factors suggest that these two main investment categories will return to following their own path.

First, inflationary pressures continue to subside. The latest evidence to this point came with the latest release of the Consumer Price Index (CPI) for March that included the headline CPI annualized inflation rate plunging meaningfully below the core CPI rate, which historically has been a confirmation signal that pricing pressures are set to fall further in the months ahead. While both readings are still hovering uncomfortably above 5%, things continue to head in the right direction on the inflation front. Knowing that inflation is the primary determinant of bond returns, the fact that pricing pressures continue to fall is definitively bullish for bonds. As an added plus, it is also constructive for most stocks as well.

Next, it appears increasingly likely that the U.S. economy is heading toward recession later in 2023 and potentially into 2024. This probability increased measurably over the last month in the wake of a run of bank failures, as the fallout effect is likely to be meaningfully tightened lending standards from banks that may be facing similar challenges with their credit risk management and loan portfolios in the months ahead. This is decidedly negative for stocks at least in the short-term, but it is decidedly positive for bonds including long-term U.S. Treasuries assuming inflationary pressures continue to fall (and tightening lending standards from banks should foster this outcome), as investors seek to protect against the potential downside in stocks by shifting to the safe-haven of U.S. Treasuries.

The keys to watch for bonds going forward. Stocks have been surprisingly resilient in the face of accumulating downside pressures so far in 2023, but this may eventually turn. In such an event, bonds including long-term U.S. Treasuries still have meaningful room to advance to the upside following their precipitous decline through much of 2022.

A key level I am watching in the current environment for signs of further sustained upside from the U.S. Treasury market is the $108.85 range on the iShares 20+ Year Treasury Bond ETF (TLT). Following the strong rally from its October lows, the TLT has approached this $108.85 level on four separate occasions since December, only to be turned back each time. If TLT can break decisively above this latest resistance level, the next stop would be measurably higher in and around the $118 level. This would imply a 30-year U.S. Treasury yield falling back toward 3.00%. The upside breakout that has already occurred in shorter duration Treasury instruments suggests that such a breakout for TLT may be imminent. And it should be noted that any such surge in bond prices and subsequent declines in yields has a feedthrough effect of helping to support stocks and their valuations.

Bottom line. While it has been a difficult environment recently for bond investors including those that are seeking to diversify against stocks, the underlying economic and market conditions are increasingly shifting toward the long-term diversification benefit from bonds relative to stocks returning as we continue through 2023. The key will be that inflation needs to continue coming down, which will be worth watching in the coming months.

Disclosure: I/we have a beneficial long position in the shares of TLT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. I am long selected individual stocks as part of a broad asset allocation strategy.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Tracking #: 428148-1