On Thursday, the U.S. Department of Justice (DOJ) in conjunction with a bipartisan group of state attorneys general announced an antitrust lawsuit against technology giant Apple. The filing claims that Apple engaged in anticompetitive behavior through its control of the iPhone, resulting in harm to businesses and consumers. This suit is the latest in a series of recent bipartisan antitrust filings against some of the largest tech related companies including Google, Meta Platforms, and Amazon. And the U.S. Department of Justice is not alone in pursuing legal action, as the European Commission has also recently filed similar suits against many of these same corporate giants. Given the ongoing torrent of legal activity, it is reasonable to consider the potential long-term implications for the stock prices of these companies.

The Magnificent Seven. Over the past year, a group of highflying tech and tech adjacent companies gained the moniker “The Magnificent Seven”. This select group includes Apple, Microsoft, Amazon, Google, Meta Platforms, Tesla, and NVIDIA. This designation came from the fact that these seven companies alone accounted for more than 80% of the upside return of the S&P 500 in 2023. In short, without these seven companies, the benchmark index that gained more than +25% last year would have advanced far less. In the process, the stocks of these seven elite companies came to make up nearly 30% of the entire weighting of the S&P 500 Index. Huge company to say the least.

Thus, it is notable that the recent antitrust suits are now targeting four of the seven stocks listed above. Given their enormous size, will these legal threats put a dent in what to this point has been relentless upside performance for many years?

Using history as a guide. In seeking to answer this question, it is worth noting that this is not the first time that major governments including the United States have targeted technology giants for antitrust behavior. As a result, history provides us with a guide for what we might expect in the coming years in the wake of these legal pursuits.

Microsoft. We will begin with the most recent major example, which is yet another of The Magnificent Seven brethren in Microsoft. Back at the turn of the millennium, the U.S. DOJ along with various state attorneys general filed an antitrust lawsuit against what was then regularly the largest company in the world by market cap for using its monopolistic position with the Microsoft Windows operating system to squash competition in the web browser market with Internet Explorer. The case was first filed in 1998 and eventually reached a settlement in 2001.

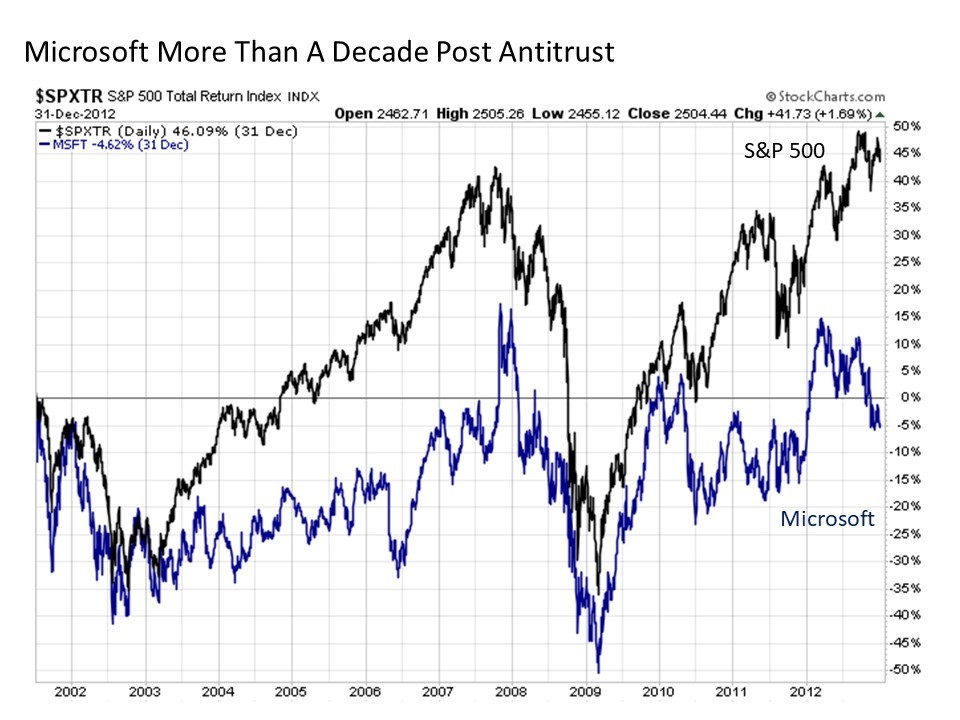

So how did Microsoft perform in the wake of its antitrust battle with the U.S. government?

For the next twelve years, the previously dominant tech giant languished. In a volatile environment from mid-2001 through the end of 2012 where the broader S&P 500 still managed a near +50% return, Microsoft posted a cumulative negative total return. As we have seen since, the stock eventually found its way back to prominence and the top of the market cap charts, but it required a major shift to new strategic innovations for the company that remains elusive to many other former tech giants from the dot.com era and before to this day.

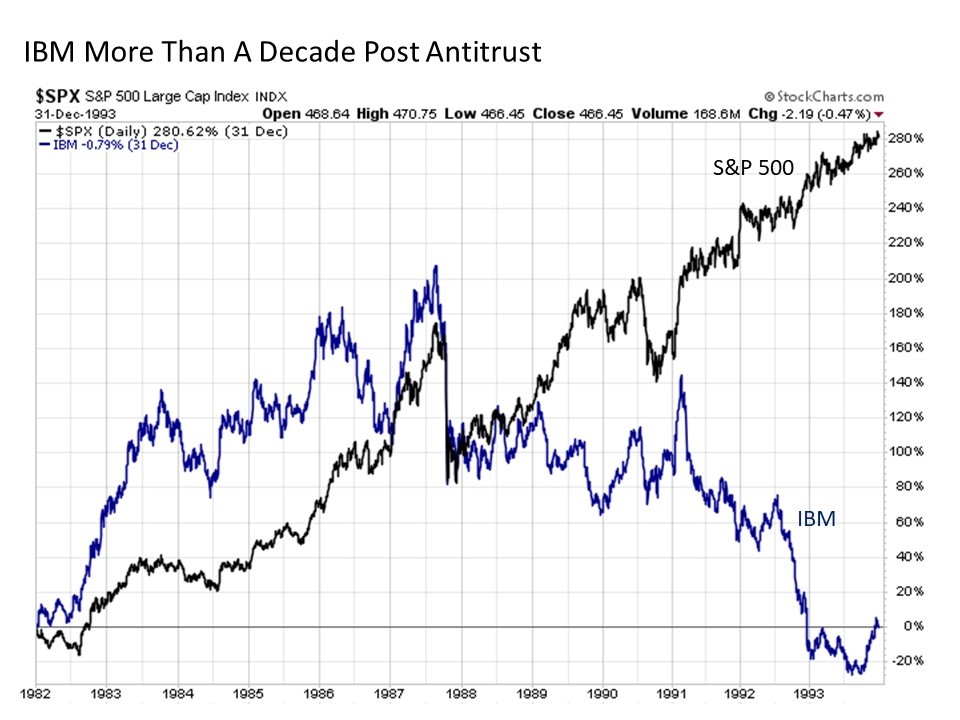

IBM. Before there was NVIDIA, before there was Apple and Microsoft and Cisco Systems and Intel and Hewlett Packard and Dell Computer and Sperry and Burroughs and many other notable names from information technology’s present and past, there was IBM. Up into the early 1990s, IBM was the tech innovator and monster with all other tech players operating in its wake. The Department of Justice launched its antitrust case against IBM at the end of the 1960s, and it lasted for more than a decade into the early 1980s before it was finally dismissed. So how did IBM perform in the wake of its antitrust litigation?

At least initially, IBM appeared to remain unscathed by all of the legal distractions from the preceding decade plus. But by the mid-1980s, the stock price luster finally departed from the company. And by 1993, more than a decade after the antitrust suit was over, IBM stock was lower by as much as -20% on a cumulative return basis.

Implications for today. A couple of important points are worth emphasizing before going any further. First, a historical sample of two companies certainly does not even begin to provide a statistically significant sample to draw any meaningful conclusions. The past examples of Microsoft and IBM are merely anecdotal. Next, the operating environment for major multinational corporations is very different in the mid-2020s than it was in the 1970s and the early 2000s, so what may have been a major inhibitor to corporate growth decades ago may no longer be so today.

Nonetheless, these past lessons provide some key takeaways that are worth monitoring as we consider the potential price performance of these largest technology companies more specifically the broader S&P 500 where these companies have such a disproportionately large weighting in the index.

First, all of these companies being pursued for legal action today have stock valuations that would be considered expensive by historical standards with an average price-to-earnings multiple (or price-to-operating cash flow multiple in the case of Amazon) that are all north of 24 times earnings and reaching as high as 32 times earnings. Remember the days of the Graham and Dodd 15x multiple from back in the day? And with the Fed funds rate at 5.50% and the 10-Year U.S. Treasury yield north of 4%, we can no longer simply excuse such sky high absolute multiples as a byproduct of a zero interest rate environment.

Next, all of these companies are already huge. With combined sales of $1.4 trillion and a combined market cap of $7.6 trillion, the law of big numbers can start to become an increasing weight in seeking to become even “huger” than you already are.

Lastly and most importantly in the context of these antitrust lawsuits, information technology dominance is a capricious and fleeting business. Just when you think you are dominating the world as the largest player in a product or service that no other provider can match (think desktop computers in the 1990s), new and more exciting innovations come along that render your dominance a thing of the past as new entrants rise to the top and the old guard slowly fades into the past. As a result, the need to constantly be aggressively innovating to maintain market leadership in existing and new technologies is fierce. Why does this matter? Because if you are a major tech giant and you are not focusing all of your efforts on technological innovation and enhancements and are instead diverting and draining labor and capital resources into a protracted antitrust fight, you run the risk of your company eventually falling into the same fate that befell IBM and Microsoft in the past.

Bottom line. The tech giants that have topped the financial media headlines and investor portfolio allocations for so many years are increasingly confronting antitrust legal pressures. Whether this latest round of tech giants will be better able versus those in the past to weather the long-term operational and competitive storm in the coming years remains to be seen. In the meantime, it is a potential source of downside risk that is worth consideration not only for these selected names but the broader market index that is so dependent on their stock price performance.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 557414-1