Summary

- The S&P 500 hit a new high for the year, but several signs of downside pressure continue to accumulate under the surface.

- U.S. mid-caps and small-caps are lagging, and the stock market rally has an increasingly narrowing breadth.

- The potential exists for this pressure to pull stocks back to the downside, but it also offers better entry points for investors in various sectors.

All appears well with the U.S. stock market. Just this week, the S&P 500 hit a new high for the year, and the October 2022 lows look like an increasingly distant memory. And the threat of an immediate pullback in stocks does not at all appear imminent. Despite the feel good headline mojo for stocks as the summer gets underway, unfortunately a different story continues to accumulate under the surface.

The strong one. At first glance, it looks like everything is looking up for U.S. stocks. Since the mid-October lows, the S&P 500 has rebounded more than +21% to date. Some might actually call this a new bull market depending on how you define such things. And while we continue to hear rumblings of an economic recession on the horizon at the same time that the Fed appears determined to continue to raise interest rates even further into the summer, the recent spate of banking failures has calmed and handwringing about the debt ceiling may soon be moving behind us. All of this coupled with the S&P 500’s move back above its ultra long-term 400-day moving average for the first time since last August are giving reasons for optimism.

Under the surface. Unfortunately, when we go beyond the headline index and look underneath the surface of the market, we find several straws in the stack.

SMID. The first areas of concern are revealed when we look down the size spectrum of the U.S. equity market. First, while U.S. large caps are striding to the upside, the same cannot be said for U.S. mid-caps as measured by the S&P 400 Mid-Cap Index. Since early February, U.S. mid-caps are lower by more than -10%. In the process, the mid-cap index remains trapped below its 50-day, 200-day, and 400-day moving average resistance levels.

The look is even worse for U.S. small caps as measured by the S&P 600 Small Cap Index. Not only are small caps off by more than -14% since early February and the index is also locked below key technical resistance levels, but they are not all that far removed from their October 2022 lows at this point.

Why does the lagging performance of mid-caps and small caps matter? Because historically when stocks emerge from a bear market, it is small caps and mid-caps that are leading to the upside, not lagging if not absent from participating at all.

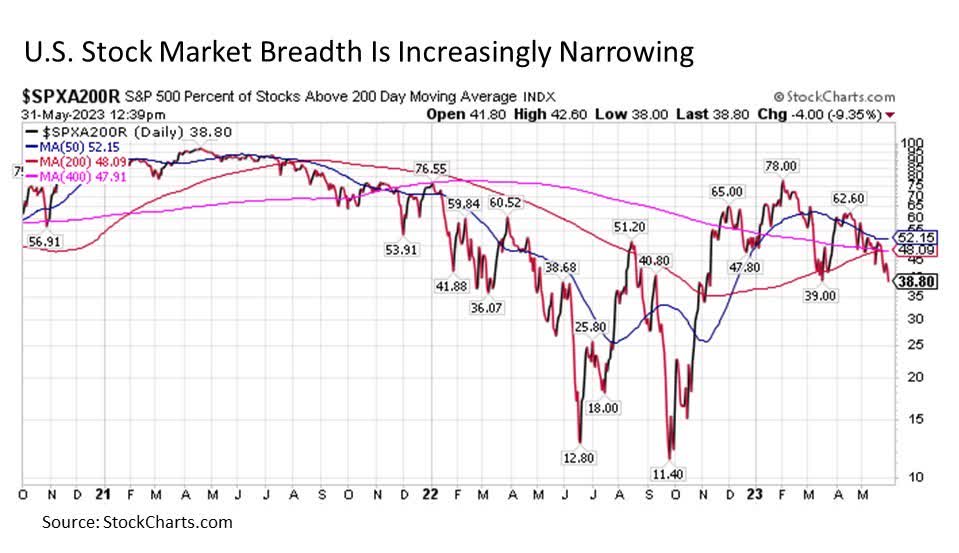

Breadthless. Another blow against the ongoing U.S. stock market rally is the notable and increasing lack of breadth. Although the S&P 500 continues to rise from its October lows, it is doing so with fewer and fewer stocks driving the market to the upside. This is evidenced in one of many ways by considering the percentage of stocks within the S&P 500 that are trading above their 200-day moving average. In a typical bull market run, we can see as many as 75% to 85% or more of stocks trading above their respective 200-day moving averages. In contrast, today we have less than 40% of stocks trading above their 200-day moving averages, which is down from as high as 78% in early February and 62% in early April. Adding to the challenge, this is a reading that continues to track decisively to the downside.

Why does the increasingly narrowing breadth behind the stock market rally matter? Because if only a few stocks are leading the charge to the upside, they are likely doing so with outsized returns that may not be sustainable (cough…AI…cough …bubble…cough). More importantly, if these few leaders stumble and roll back over to the downside, there is little left in terms of stocks moving to the upside to help keep the rally going. Such is the risk associated with the ongoing stock rebound.

Line up the dominos. So how narrowly defined is today’s S&P 500 advance? A review of sector performance is particularly revealing. Let’s line them up.

The S&P 500 consists of eleven different sectors according to the Global Industry Classification System, or GICS. Of these eleven sectors, nine are trading lower since early February. Some decidedly so including energy, materials, financials, and real estate all down more than -10% and industrials, health care, and utilities lower in the neighborhood of -5%. What about the two sectors that are higher? Communications is up a solid +5%, but it is information technology that is soaring up more than +15%.

In short, we have effectively one sector in technology that is almost solely responsible for dragging the S&P 500 higher since early February. Otherwise, it is likely that the U.S. large cap index would be following in the path of its mid-cap and small cap brethren.

Surface pressure. So while the S&P 500 may continue to show resilience to advance to the upside as we make our way into summer, it is important to note that a variety of signs of downside pressure continue to accumulate under the surface. As a result, investors should resist the temptation to read too much optimism from the recent market advance, as the potential exists for this pressure to blow and pull stocks back to the downside for another spell.

Fortunately, this pressure does have its benefits. While the headline S&P 500 may be advancing, a number of stocks across various sectors may be offering better entry points today following recent pullbacks. Moreover, attractive total return opportunities continue to exist outside of the stock market today in areas such as longer duration fixed income that may warrant a closer look while the crowds are distracted by this narrow breadth stock rally.

Compliance Tracking #:442681-1.

Disclosure: Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.