A changing of the guard appears to be taking place in the U.S. stock market. The S&P 500 Index continues to set fresh all-time highs with a year end run toward 6000 increasingly coming into view. But the leadership now driving the market to new heights has suddenly changed in recent months. Following nearly two years of prodigious leadership, the information technology sector in general and the semiconductor industry more specifically has suddenly fallen to the wayside. What segments then has assumed the market leadership mantle as we enter the final quarter of 2024.

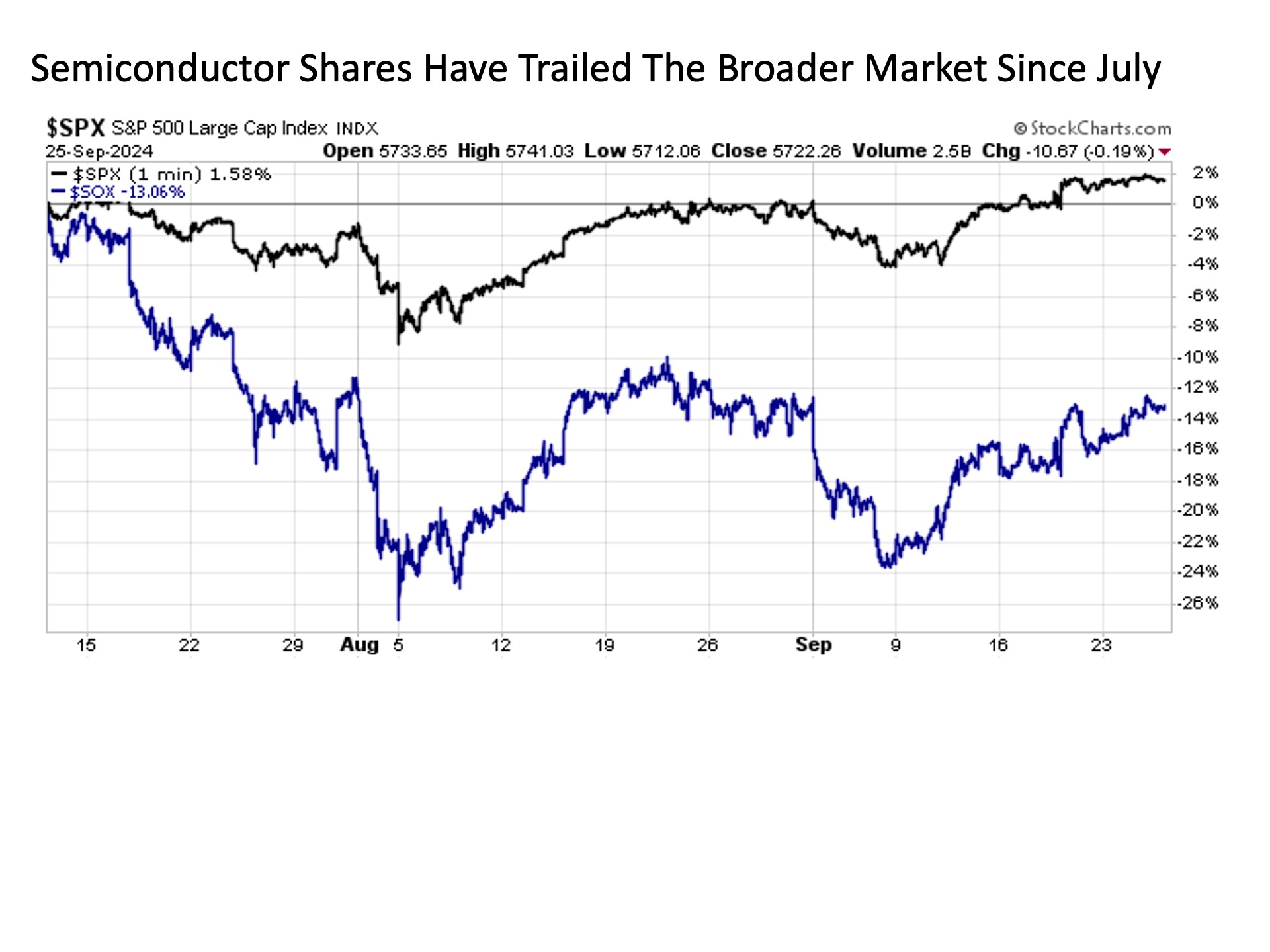

Sox knocked off. The once highflying semiconductor industry has taken a long overdue breather in 2024 Q3. Traditionally a highly economically sensitive and notoriously unpredictable segment prone to wild swings in either direction at any given point in time, semiconductor shares entered into a sharp swing to the downside starting on July 11. Whereas the S&P 500 Index has risen by just over 1% in the more than two months since, the Philadelphia Semiconductor Index, or SOX, has fallen by more than -13% and as much as -27% over this same time period.

So what are the implications of this former market leader trailing off to the downside? Impressively, much of the rest of the broader market has picked up the upside slack.

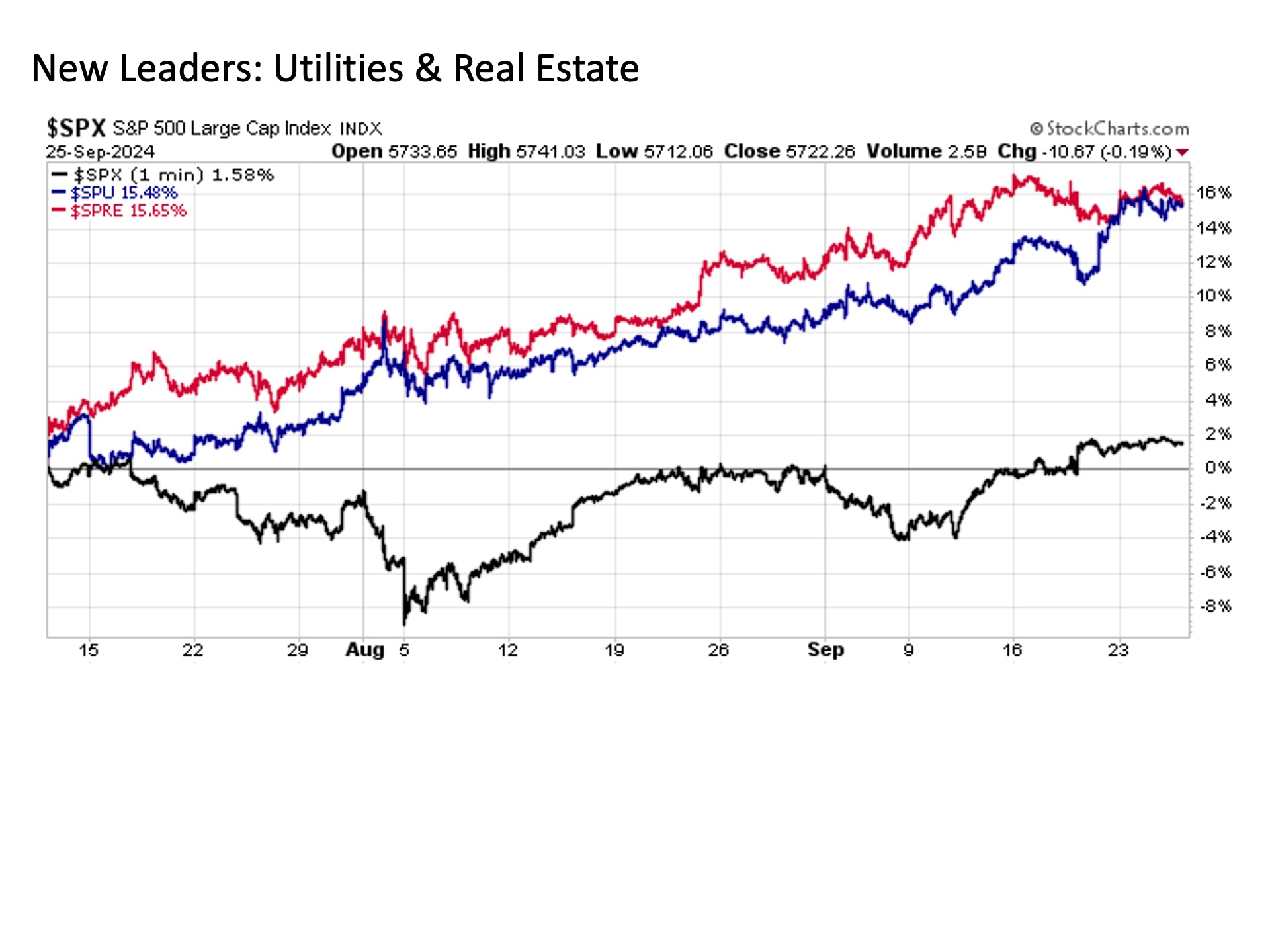

New leaders. A new set of sectors and industries are now driving the U.S. stock market higher in recent months. First among these are the utilities and real estate sector. Traditionally the staid performer often drifting toward the middle of the sector return grid, utilities shares have rallied virtually unabated for nearly three months now, having gained nearly +16% since early July. And interest rate sensitive real estate stocks have been marginally even more impressive with a similar upside advance over this same time period.

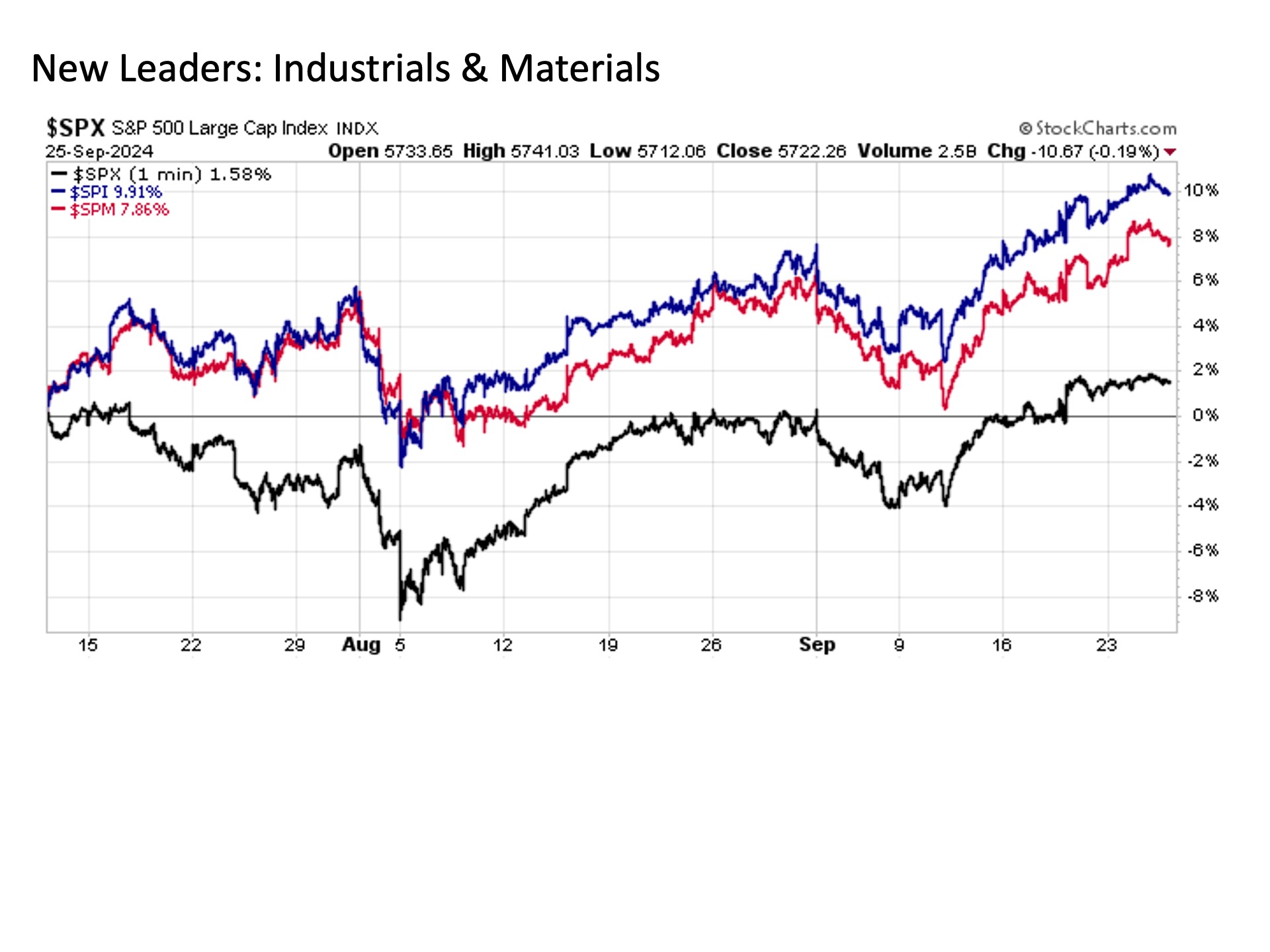

These sectors are not alone in helping to drive the S&P 500 to the upside in recent months. Consider the economically sensitive industrials and materials sectors, which are higher by +10% and +8%, respectively, since early July. Recession? What recession?

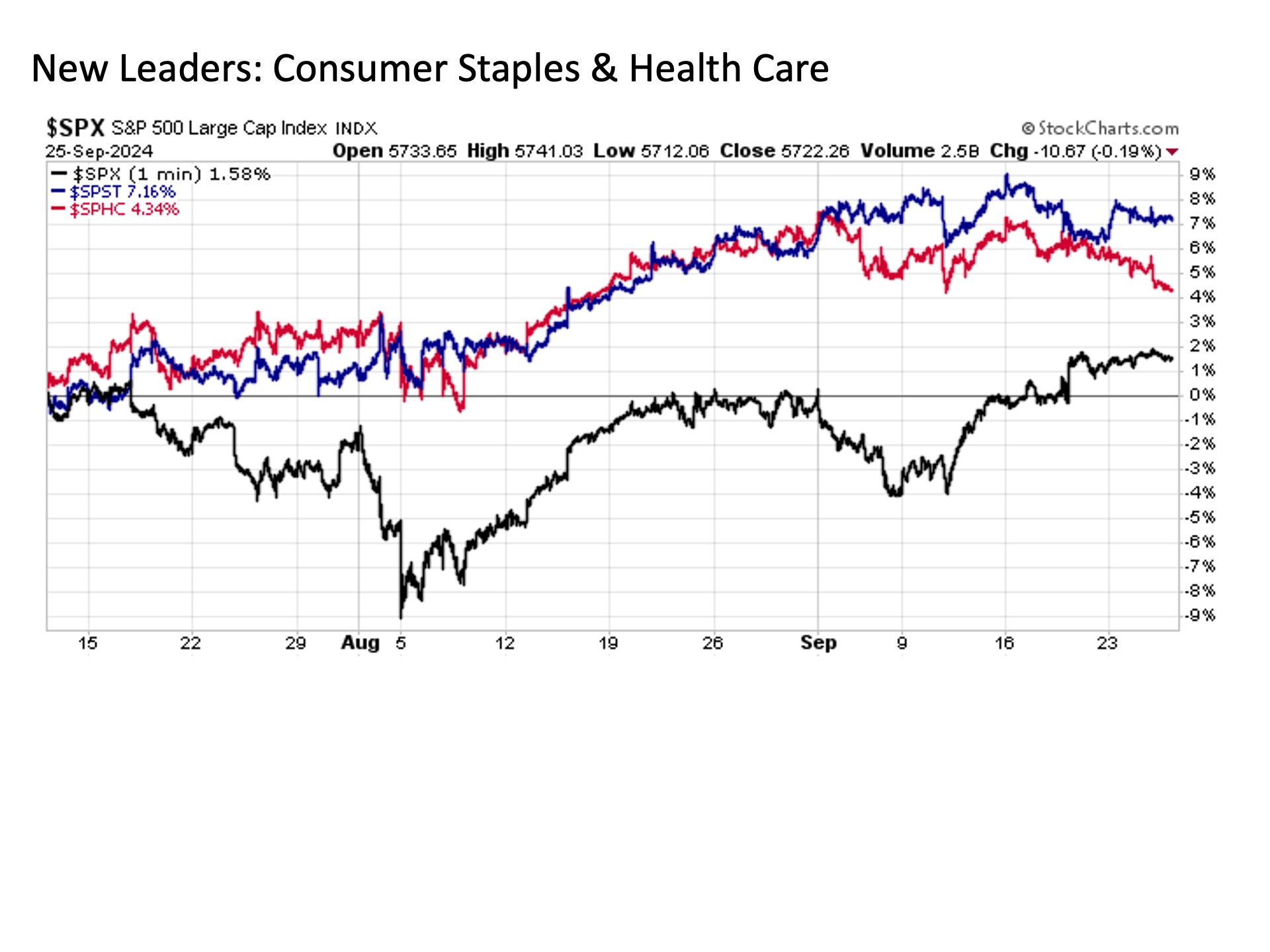

For those that are worried about recession risks, the more defensive consumer staples and health care sectors have logged their own impressive gains over the last few months with mid-to-high single digit gains.

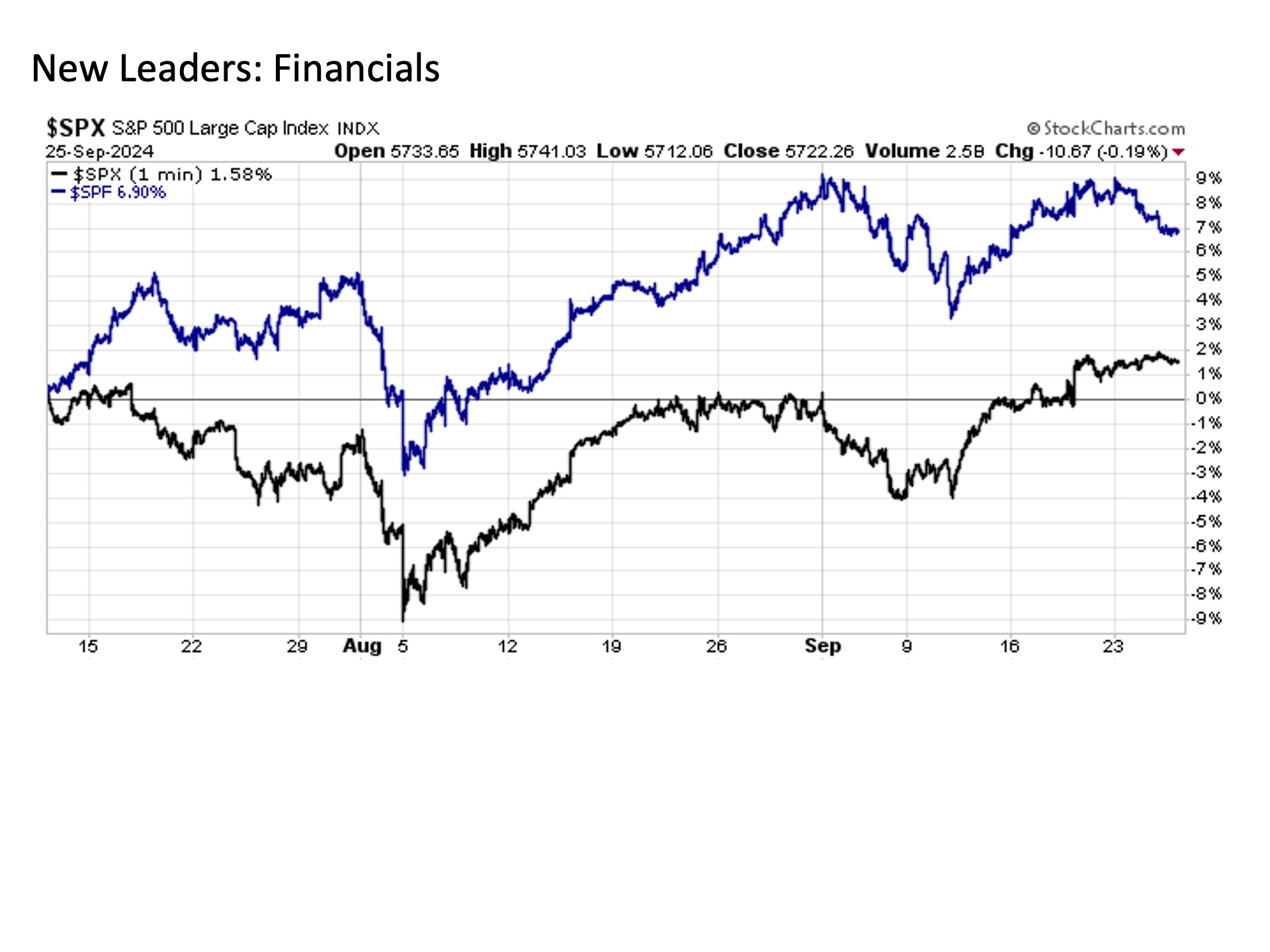

Then there is the interest rate sensitive financials sector, that is higher by +7% in recent months.

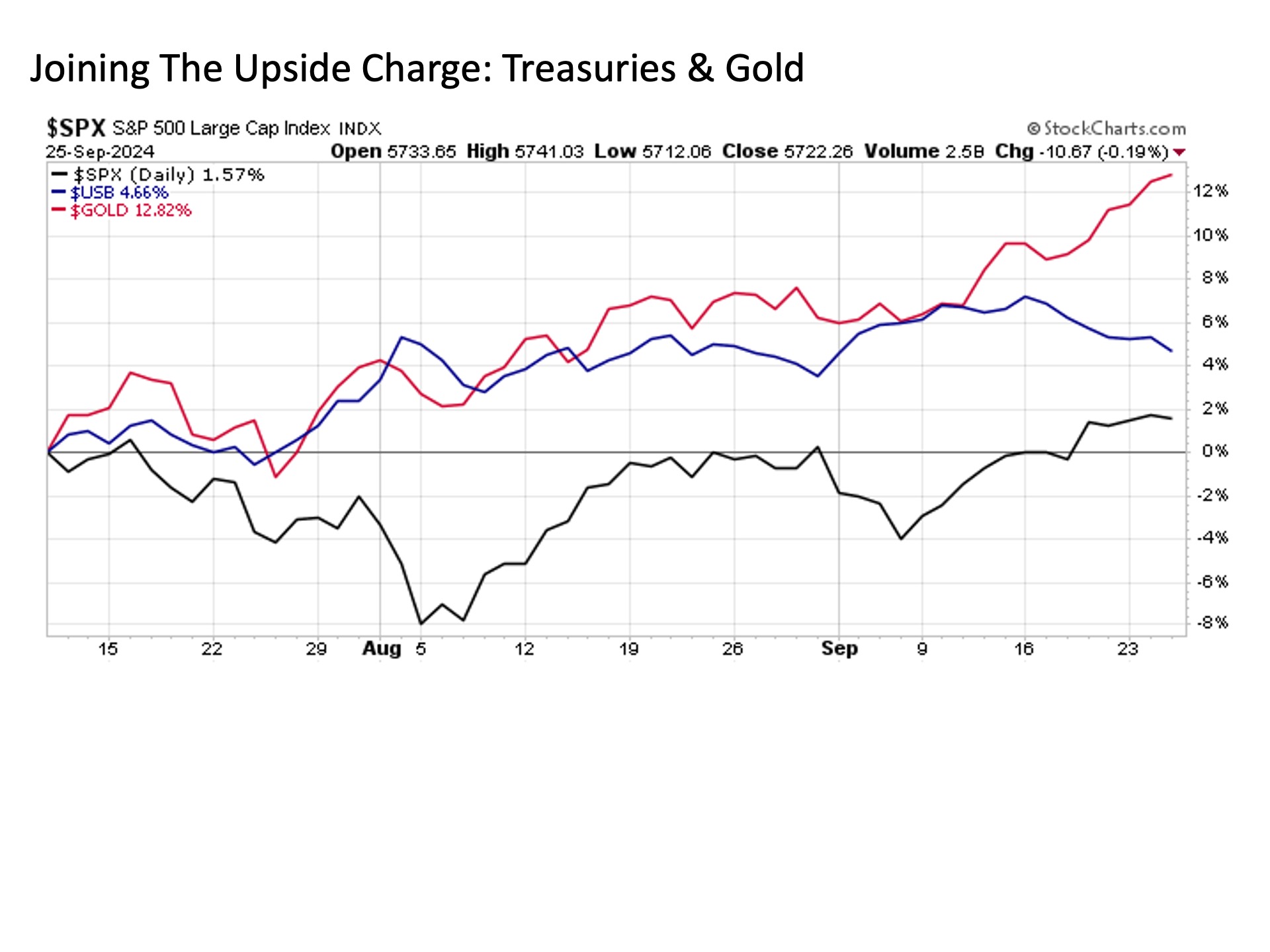

Moving beyond stocks, we have also witnessed impressive gains in recent months from the long-term U.S. Treasury market as well as gold.

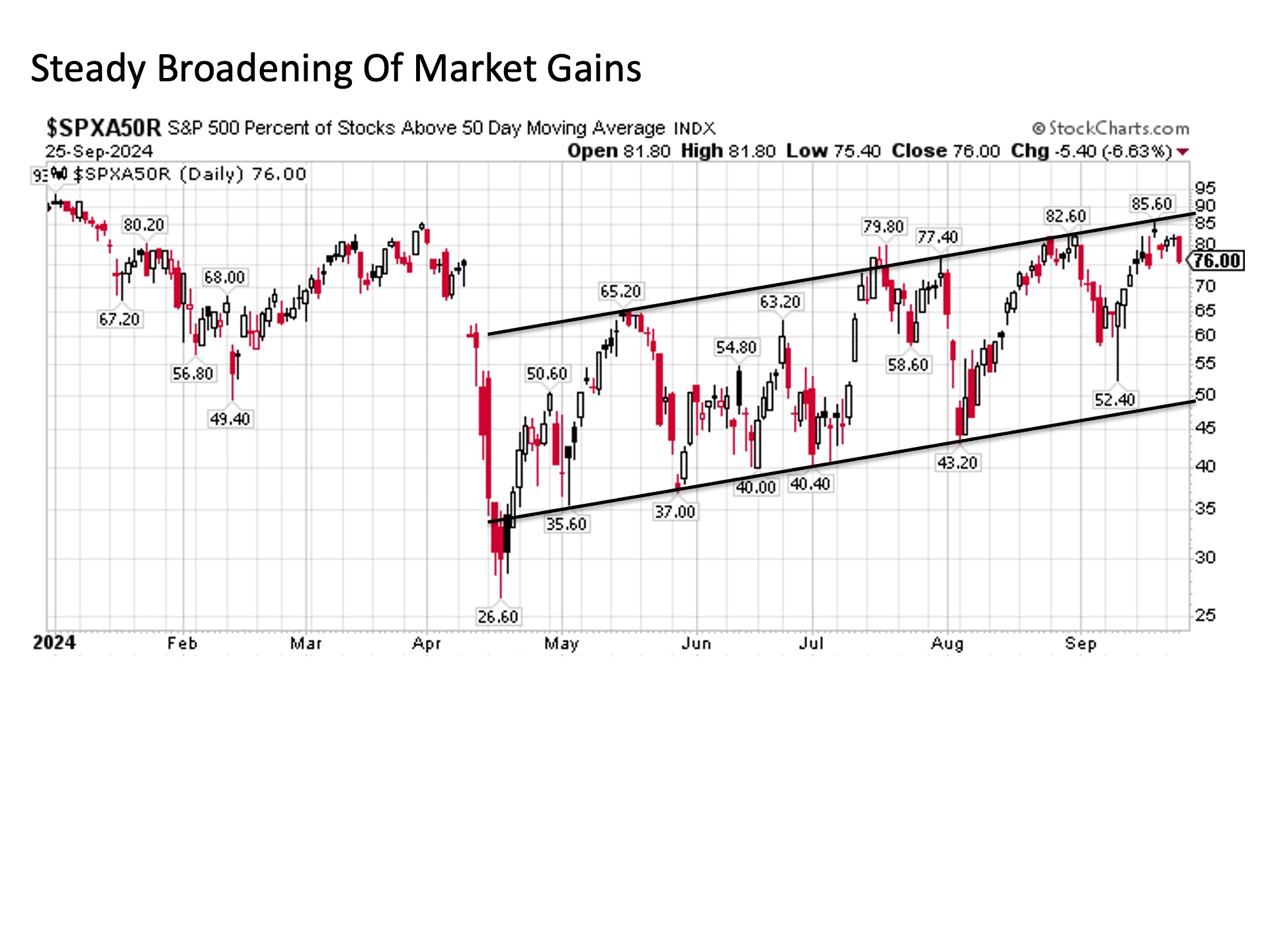

Breadth. All of these developments are positive and constructive signs for a market looking to maintain its upward trajectory through the remainder of the year and into the next. One of the primary concerns dogging U.S. stocks for much of the last two calendar years has been the notably narrow market leadership, as it had been a select few stocks from the information technology, communications services and consumer discretionary sectors that were responsible for the lion’s share of the market gains. But over the last few months, we have seen a steady broadening of performance with more than 80% of stocks across the entire S&P 500 trading above their respective 50-day moving averages.

Moreover, we have seen more than 64% of stocks in the S&P 500 outperform the headline index in 2024 Q3, which is a stark contrast to the roughly 20% to 30% of stocks that were outperforming the S&P heading into the quarter.

Bottom line. Investors may be vocalizing concerns about the economic outlook and the potential for a recession looming on the horizon. But the good news is that financial markets are continuing to advance. And the even better news is that the breadth of performance supporting financial markets has seen some healthy broadening this quarter, which helps make recent gains more sustainable as we move into the final quarter of the year.

I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 636479-1