Technology stocks have been a force behind capital market gains for nearly a decade. And for more than a year, the semiconductor industry in particular has been the market darling inspired by artificial intelligence dreams. But following relentlessly impressive gains, chip stocks have suddenly fallen on hard times. Is this a long awaited dip in chip stocks for investors to capitalize, or is this the beginning of a broader market shift? Let’s take a closer look.

Breakdown. The first important point for investors waiting for a dip in chips is that the sector overall is breaking down from a technical analysis perspective.

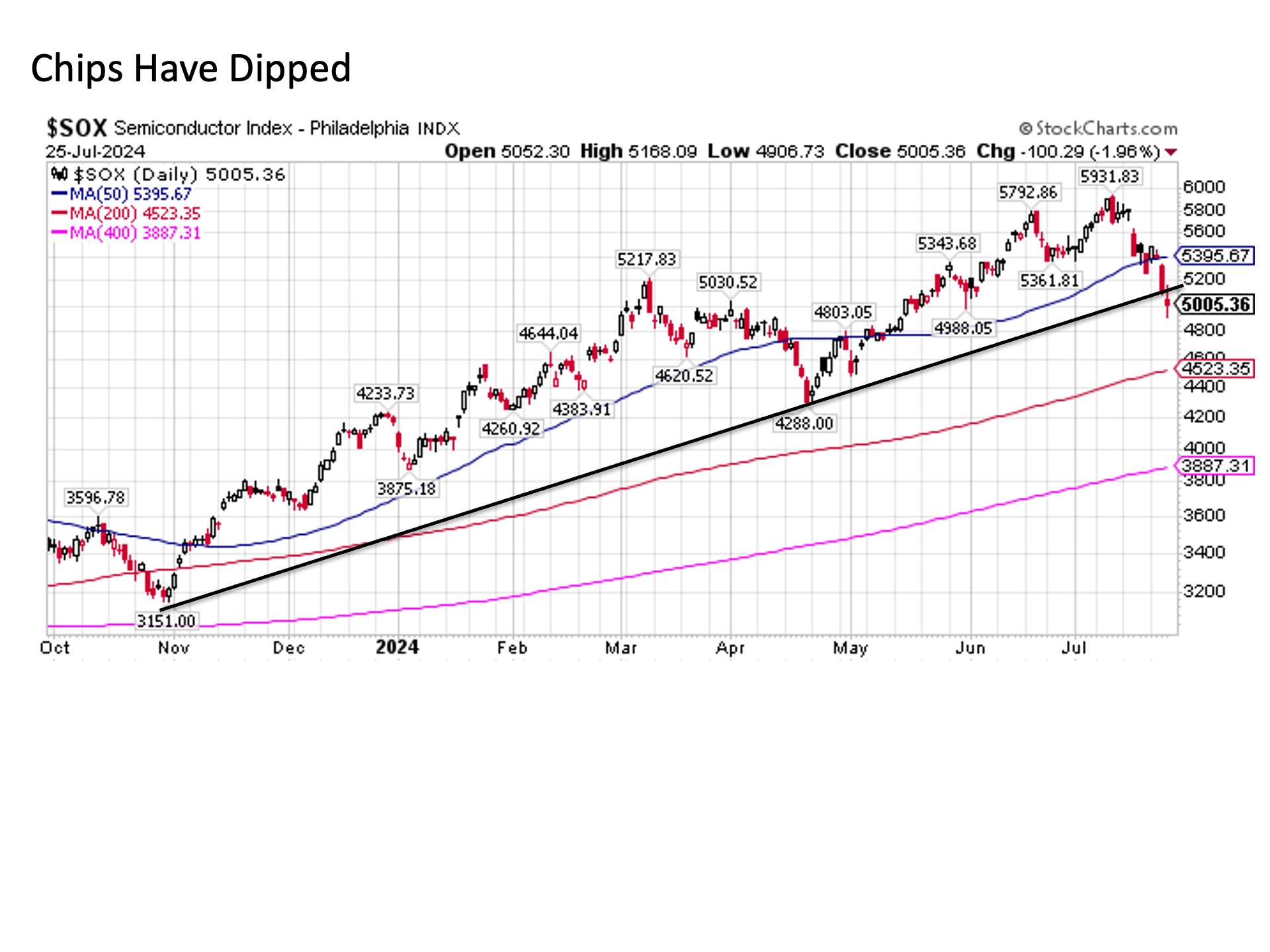

It’s worth noting that chip stocks as measured by the Philadelphia Semiconductor Index (SOX) have nearly doubled since Halloween. Along the way, the SOX has found repeated support at its upward sloping 50-day moving average (blue line in chart above). But on Wednesday and Thursday of this week, the SOX broke decisively below this key support level and continued further below its upward sloping trendline dating back to last October. This suggests that further downside might lie ahead for chip stocks going forward.

Now it is worth noting that we saw a similar technical breakdown back in April, as the SOX broke decisively below its 50-day M.A. mid-month and grinded until early May before reclaiming this key support level. Thus, it is far too early to draw any long-term conclusions related to the recent break in technical support. Monitoring how chip stocks respond through next week will be important in determining whether the recent correction is short lived. In the meantime, semiconductor stocks are already down more than -17% from their highs from just two weeks ago, and the next key support level for chip stocks is another -10% lower from current levels and nearly -25% below recent highs.

Even if the SOX were to fall back to its 200-day moving average support, this would only bring chip stocks back to levels that would have been all-time highs as recently as January. This is how elevated chip stocks have become.

Blowing the diode. Another challenge increasingly confronting chip stocks even after the latest dip is valuations. Historically, semiconductor stocks have traded at a discounted valuation both on an absolute basis as well as relative to the broader market. For example, throughout the 2010s, semiconductor stocks traded at a composite forward price-to-earnings ratio in the 10x to 15x range. This typically discounted valuation highlights not only the higher risk associated with owning chip stocks, but also the extreme cyclicality and economic sensitivity associated with the industry.

So where are chip stocks collectively trading today? Semiconductor stocks are currently trading at a forward P/E multiple north of 30x earnings. This is as rich as chip stocks have been in a quarter century, which suggests that the risk-reward for this recently high flying segment of the market is tilted to the downside at this stage even if they manage to find their footing and rebound to the upside in the short-term.

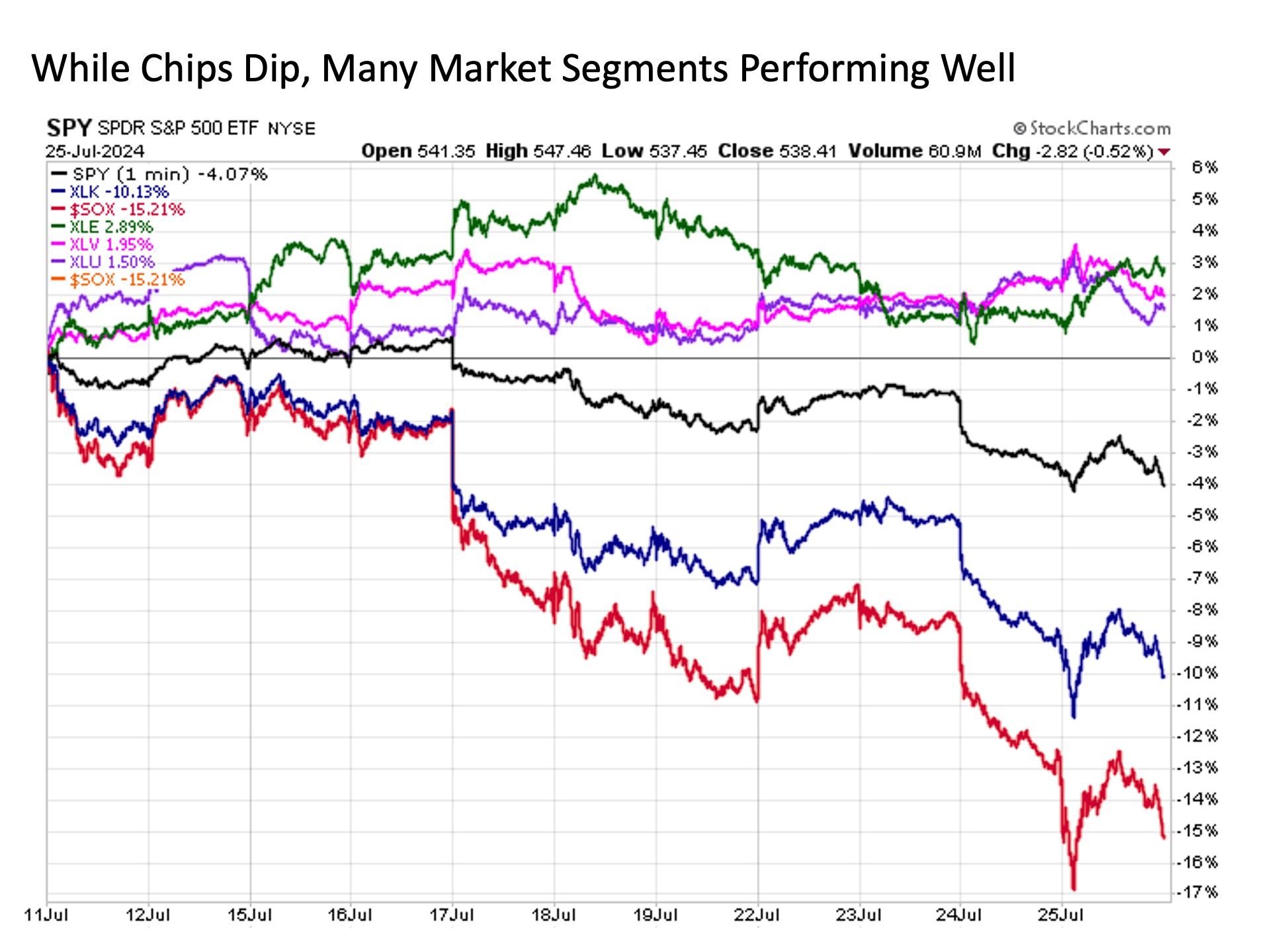

A market of stocks. The recent weakness in technology stocks in general and semiconductor stocks in particular have dragged measurably on the broader market. Since July 11, for example, tech stocks are lower by double-digits led by chips to the downside. This has resulted in the broader S&P 500 falling by more than -4% over this same time period.

Despite this broader weakness, it’s important to remember that the stock market is a market of stocks. Just because one or two major segments of the market that have been leading to the upside suddenly falter, this does not mean that many other sectors within the market are not performing well. To this point, since July 11, the energy sector has advanced by +3%, health care stocks are higher by +2%, utilities have advanced by +1.5%, and consumer staples are up nearly +1%. All of these major sector gains have come at a time when the broader market is solidly lower.

Bottom line. Semiconductor stocks have fallen into correction over the past couple of weeks, which have pulled the broader market lower. This pullback may ultimately prove fleeting as it did back in April, but even if the chip dip becomes more prolonged, it’s important to remember that many market segments may continue to perform well underneath the surface.

I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 608716-1