Changes to the political landscape continue to unfold in the wake of the Republican sweep in the 2024 elections. The financial market reaction has also been dramatic, as U.S. stocks have rallied strongly in the days since Election Day with the removal of the uncertainty of who will be running the executive branch as well as the U.S. Senate and House of Representatives for the next two years. But one might also get the impression when following the financial media along the way that the anticipated policies from the new GOP led Washington DC have already been put in place yesterday even though the transition of power won’t even start to begin for more than a month from now.

It is important to remember that what is promised on the campaign trail typically is very different from what is eventually implemented into law and subsequently executed. Even more so, it takes time before any such policies start to take effect under any new government in Washington.

So what can we more reasonably expect from our politicians and financial markets as new leadership takes hold.

You know time is of the essence. History provides a useful guide for what to expect over the next two years. Of course, this is not the first time that we have seen a sweep scenario emerging from a Presidential election in recent years. In fact, we have seen three political party sweeps in the last two decades alone. And both the timing of major legislation being enacted and the U.S. stock market reaction along the way bears some striking similarities to note as we advance toward 2025 and beyond.

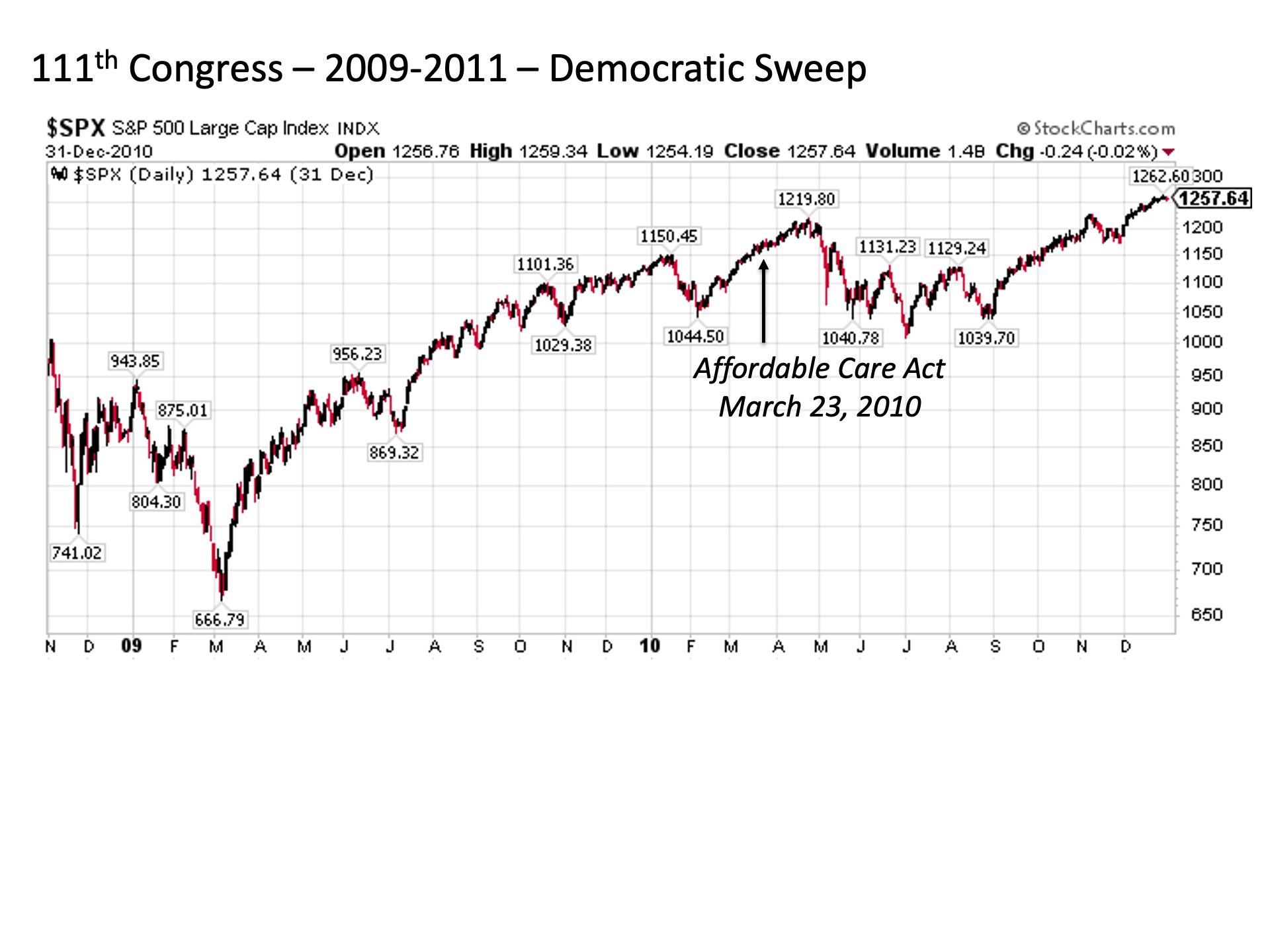

It takes time to let the coffee percolate. Let’s begin with the first of these three sweep outcomes that took place on Election Day in November 2008. In the midst of the Great Financial Crisis, President Obama scored a decisive victory accompanied by the Democrats adding a whopping eight seats in the U.S. Senate and 21 seats in the House of Representatives. The party came to Washington in 2009 with a clear mandate to lead with reforming the health care system as a primary objective. Yet despite all of these advantages, it took Democrats more than a year after taking control before finally signing into law the Affordable Care Act (ACA) on March 23, 2010.

So how did U.S. stocks perform along the way over these first two years. In 2009, the S&P 500 finally bottomed in March before rallying strongly through the remainder of the year and into the early part of 2010. In fact, it wasn’t until around the time that the ACA was finally passed that the U.S. stock market stalled and traded sideways for virtually all of 2010 until the very end of the year under Democratic control.

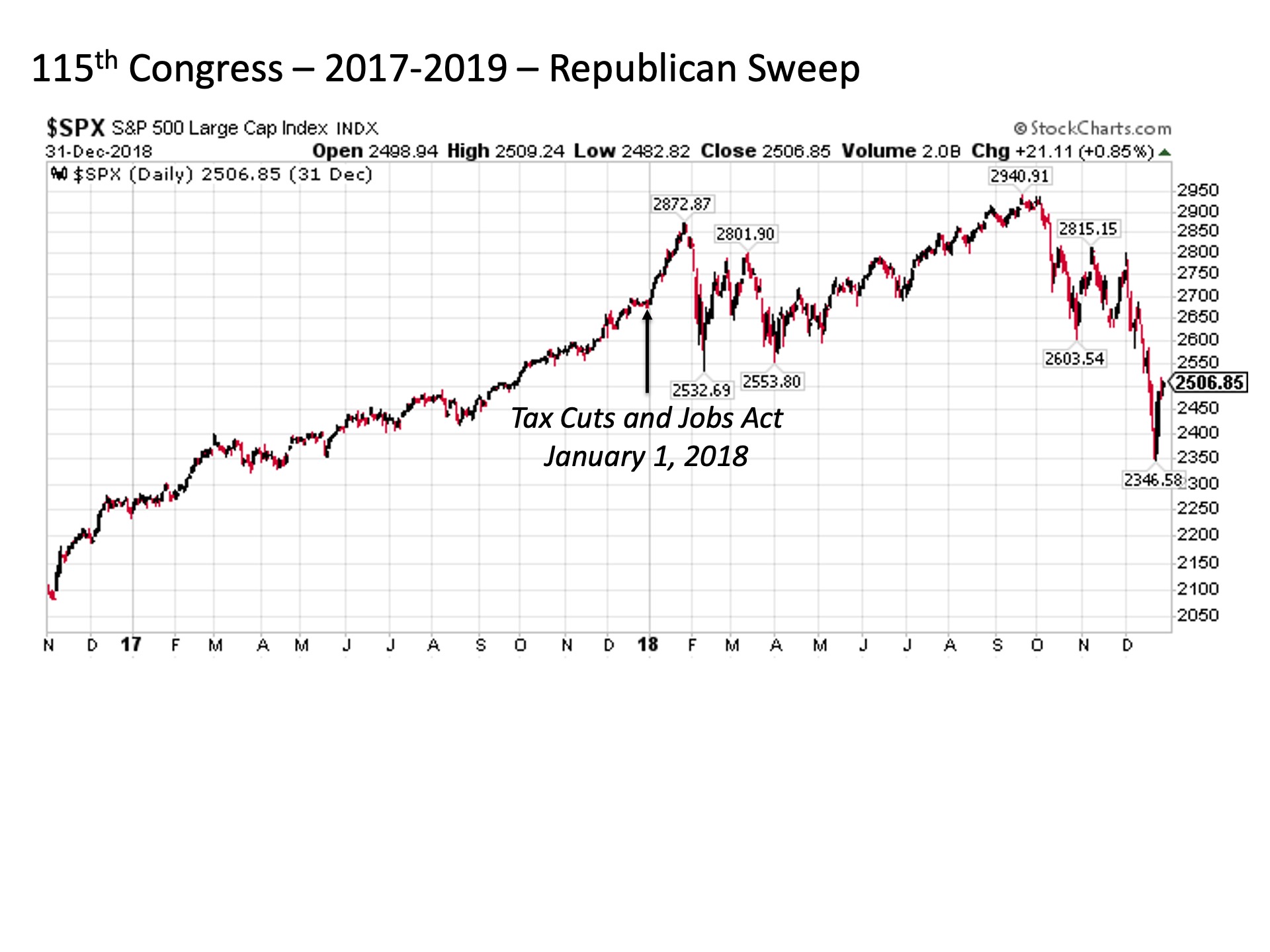

You gotta be patient. Let’s fast forward to our second recent sweep scenario. In 2016, the GOP swept into power with an unexpected win for President Trump accompanied by the Republicans taking control of the Senate and House. It took only hours after the election results made the political results clear that the markets turned their focus to the pro-growth economic policies and major tax cuts that were likely to follow from Republican led fiscal policy. Yet despite controlling the White House, the Senate, and the House, the Tax Cuts and Jobs Act was not signed into law until January 1, 2018, virtually a year after the GOP claimed control in DC.

But even more so than 2008, financial markets wasted no time finding their giddy up following Election Day in 2016. For the remainder of 2016 and throughout all of 2017, U.S. stocks moved higher in virtually a straight line. It wasn’t until the much anticipated tax cuts were finally signed into law in 2018 that the stock market subsequently faltered, moving to the downside in the second year of GOP control.

It takes time to get the dough and get the ring. What about the third recent scenario? This played out in 2020. Different party once again, but notably similar results. This time, the Democrats scored the sweep in taking control of the presidency, Senate and House coming out of the 2020 election. This time, the mandate was to continue resuscitating the economy emerging from the COVID pandemic while enacting major spending projects. Nonetheless, it took more than a year before the landmark Inflation Reduction Act was signed into law on August 16, 2022.

Much like the previous two sweep episodes, U.S. stocks exploded higher in the first year under single party control in Washington. It wasn’t until the second year when legislation was signed into law where markets took a swing back to the downside.

Bottom line. Remember, it takes time. We’ve been hearing it a lot already, and it’s only going to continue in the coming weeks. We’ll hear a lot about the tax cuts and the tariffs and the deregulation and so on that many in the financial media are discussing as if they’ve already taken place. But the reality is that the current leadership is still in power until January, and even when the GOP takes full control in January, it’s very likely going to take a while even under the most ambitious timelines before any of these policies are finally instituted if at all. And if recent history is any guide, investors could reasonably anticipate that the stock market may perform well in the first year of 2025 in anticipation of this legislation coming to pass, while the second year of 2026 may bring a different story once these policies are finally signed into law. It will be interesting to see how it all plays out this time around, but in the meantime remember that it takes time.

I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 658279