Summary

- The bear market continues, but such challenges are all part of investing’s rich pageant.

- The looming debt ceiling battle is a likely non-event for capital markets.

- A new secular phase may be underway.

- How long will the current cycle last?

- Remain true to your long-term investment philosophy.

Maria: “You should get out of these clothes immediately. You’ll catch your death of pneumonia, you will.”

A Shot In The Dark, 1964

Clouseau: “Yes, I probably will. But it’s all part of life’s rich pageant, you know?”

After more than a year of a back and forth downward slide, stocks continue to struggle. Frustrating indeed, but such challenges are all part of the experience of investing in the U.S. stock market. Nobody ever said that the art of allocating capital in order to achieve a rate of return well in excess of the risk free rate offered up by an FDIC insured savings account would always be easy. But maintaining patience and discipline to a long-term investment philosophy during such periods of short-term downside volatility have been consistently rewarded dating all the way back to the buttonwood tree more than two centuries ago. It’s why we endure it, and today is no exception. So what then should we make of the most pressing risks confronting stocks today?

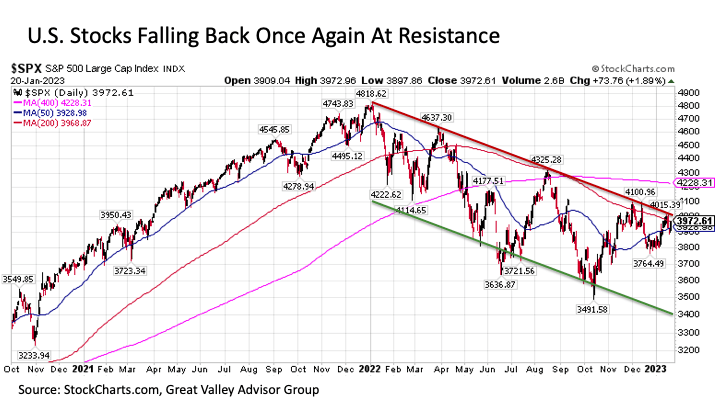

Fall on me. The U.S. stock market has been mired in a bear market downtrend dating back to the start of last year. On four previous occasions, the S&P 500 index failed at what has become downward sloping trendline resistance as shown by the red line in the chart below.

The latest attempt at an upside breakout was denied last week, as stocks retreated from its latest lower high for three straight trading days before a strong Friday rally returned the S&P 500 Index to a separate yet closely related resistance level at its downward sloping 200-day moving average. While stocks are likely to continue to try to grind out a move to the upside, the short-term path of least resistance for U.S. stocks remains to the downside.

So what are the latest forces pressuring stocks as we move toward the end of January? The steady and sharp downward revision in projected corporate earnings and operating profit margins on the S&P 500 certainly do not help, particularly in a market that is already trading at a historically rich 22 times earnings and climbing even as stock prices continue to fall.

Begin the Begin

Another issue that many investors are watching closely comes from the political sphere in the looming debt ceiling debate in the U.S. Congress. Should investors be worried about the potential fallout effects from this political standoff as events unfold?

The answer here is very likely no. Are politicians in Congress likely to take us to the brink if not slightly beyond with their game of political chicken? Almost certainly. But it is important to remember that this will not be the first time that markets have had a front row seat to such volatility inducing theatrics. We’ve seen this game many, many times before, and markets typically maintain the cool confidence that beyond the theatrics and posturing, politicians will do what needs to be done at the end of the day. This is why capital markets have had little to no reaction to the prospects of a protracted debate over the debt ceiling.

But another important point is worth remembering here. No member of Congress, regardless of where they may reside on the vast political spectrum, has any incentive to sink the U.S. stock market and plunge the global economy into crisis. Such is the implicit bet the market makes. But if an instance arises where politicians get too cute with their rhetoric and take things too far, the market has no qualms about swiftly casting policymakers knee deep in the fire to essentially say “enough is enough”.

Case in point: back on September 29, 2008 as the Great Financial Crisis (GFC) was rapidly unfolding, the U.S. House of Representatives unexpectedly failed in their vote on an emergency financial rescue package. As soon as the vote failed, the U.S. stock market almost immediately started careening to the downside, ending the trading day lower by nearly -9% on the S&P 500. Not coincidentally, the House wasted no time in getting the necessary legislation passed less than two days later, and markets rebounded accordingly. The only difference between then and now is that back in 2008 the global financial system was careening toward crisis, which is a stark contrast to today where the underlying banking system is well capitalized and generally healthy. This helps to explain why the bear market that started more than a year ago has been so orderly to date.

The bottom line related to political risk for today’s market is the following: Expect the market to largely look past any such threat. And if politicians try to take things too far, the markets very likely will quickly bring down the hammer with a fleeting but sharp correction to bring the policy debate and/or rhetorical nonsense to a swift end.

Begin the Beguine

Instead of getting caught up in the short-term noise that may be shifting the U.S. stock market on any given trading day, investors are better served to reflect on the memories of past markets and how the lessons learned might apply both today and in the future.

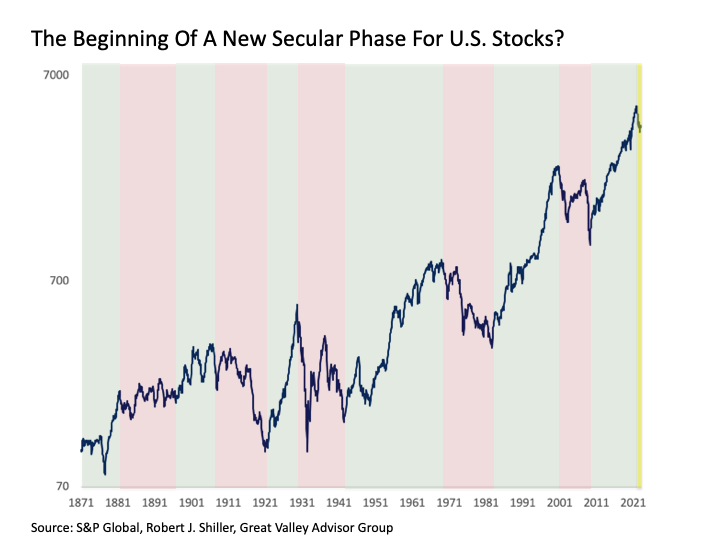

The key intermediate-term to long-term question confronting investors today is whether we have entered a new secular phase in capital markets. It is important to remember that the robust stock market gains enjoyed during the post-GFC period from 2009 to2021 was driven not by sustainably strong economic growth but instead by valuation expansion stimulated by persistently easy monetary policy from the U.S. Federal Reserve enabled by a chronically low inflationary environment fostered by globalization that effectively brought years’ worth of future stock market returns forward to the present.

What have we had since the bear market in U.S. stocks got underway at the start of last year? The worst outbreak in inflation in more than forty years forced the U.S. Federal Reserve to suddenly and aggressively shift to tight monetary policy despite a gradually weakening economy in a world that is increasingly shifting toward deglobalization and nationalization amid an increasingly uncertain and threatening geopolitical environment marked by the threat of military conflict across multiple global theaters. Put simply, the world in 2023 has completely changed in stark contrast to the preceding environment from 2009 to 2021, and stock valuations have yet to react to this new reality.

This sudden and dramatic shift suggests that we may be at the very beginning stages of a more challenging secular phase for capital markets including U.S. stocks that could last through the rest of the 2020s and into the 2030s. It is important to note that this is not necessarily a bad thing. For example, while the period from 1968 to 1982 was challenging, it is widely regarded as an excellent period for active management. In short, attractive total return opportunities across the U.S. stock market and capital markets will remain in abundance, it’s just that investors may have to work harder than they had over the past decade to capture these opportunities. Such is the advantage of active management and aligning with financial professionals that are familiar with how to navigate more uncertain markets.

Combien de Temps

In this potentially more uncertain secular environment, how long will investors have to wait before the current bear market in U.S. stocks comes to an end? The answer is multi-layered, but it is worthwhile to consider an important fact first. It’s not as though stock investors have been going hungry in search of returns over the past many years. Stocks were running hot for many years even before the onset of the global pandemic, and COVID related mega stimulus threw rocket fuel on the stock market fire through the end of 2021. As a result, it is reasonable to view the bear market since the start of last year as largely nothing more than a give back of the artificial gains induced by a deluge of monetary stimulus that subsequently had to be withdrawn back out.

Looking forward, the corrective process on the broader U.S. stock market appears to remain ongoing at least for the near-term. It is reasonable to think that by late spring to early summer the correction may have fully run its course, particularly if we have descended into recession by this point and the U.S. Federal Reserve has ended its monetary policy tightening cycle. Any capitulation style sell-off in stocks in the coming months would actually be a reassuring sign that the final bottom may be set.

But when breaking apart the U.S. stock market, many stock sectors are wondering “what bear market exactly?” This includes energy, military defense, health care, and consumer staples stocks, all of which performed well in 2022 and are poised to continue this leadership in 2023 thanks to a geopolitical, economic, and policy environment that are all supportive of such sectors.

Current upside opportunities are not limited to stocks, as U.S. Treasuries that took a hard crack on the knuckles during much of 2022 may have already bottomed a few months ago now and is higher by more than +16% since October. The same could be said for gold, which has been streaking to the upside by nearly +20% since early November.

In short, while investors may have to wait for the S&P 500 to find a bottom, capital markets are filled with attractive upside opportunities already today.

Bottom Line

The stock market decline over the past year may have been difficult to watch and endure, but it is simply a part of investing’s rich pageant in capital markets on their long-term road to the upside. Stick to your investment philosophy and resist overreacting to the short-term noise and volatility. Make portfolio changes strategically at the margins and avoid letting the fleeting volatility that can come from political rhetoric or global military threats inducing portfolio action when none may be necessary. Instead, reflect on the memories both good and bad from the rich stock market past in order to better understand what may be the likely path for capital markets including stocks for the remainder of the year and decade ahead. And recognize that the effort to capitalize on current upside opportunities may benefit from collaborating with others including investment professionals that may be more specialized in discovering active management prospects on offer today.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. Great Valley Advisor Group and Stonebridge Wealth Management are separate entities.

This is not intended to be used as tax or legal advice. Please consult a tax or legal professional for specific information and advice. Third party posts found on this profile do not reflect the views of GVA and have not been reviewed by GVA as to accuracy or completeness.