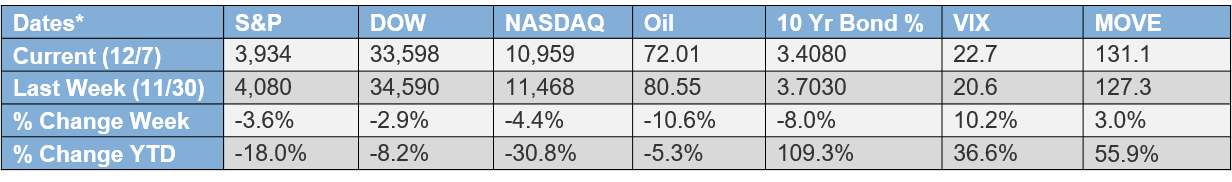

Happy Holidays to everyone out there and I hope you are all getting into the Christmas Spirit! Speaking of which, there’s a little bit of “Bah Humbug” going on in the markets right now as concerns over the timing of a Fed pivot and possible recession are weighing on investors’ minds. As of Wednesday’s close, all three major indices were in the red for the week with the S&P down 3.6%, the Dow down 2.9% and the Nasdaq down 4.4%. Yet the good news is in the past month we have been starting to see the makings of a rally. That obviously leads to the burning question “Will the markets turn it around and close out the year on a high note?”

One way to think about answering that question is to look at the classic relationship between supply and demand. Because if we can just get to a place where we have “equilibrium” then a lot of this uncertainty about our economy will go away. But we have to get there first and a lot of it has to do with supply and demand. For example, let’s look at a few high-level areas of the market where supply and demand come into play:

- Jobs – right now we have more demand for jobs than there are available workers. This is causing an imbalance in favor of the worker as they demand higher wages. Which leads to wage inflation and is something the Fed is monitoring very closely. Because they are trying to slow inflation down. It’s counterintuitive to think the Fed wants to stop hiring but in fact that’s what they are trying to do to help slow the economy down. Unemployment will naturally go up and although there is debate about where it will settle out, 4% is Powell’s target for 2023.

- Inflation – of course this is #1 on everyone’s mind but the key to this again is supply and demand. Given we have a strong consumer out there with the wage inflation and stimulus money still sloshing through the system, that makes the demand side skew may out of line with supply. And with supply chain still challenged, it causes the imbalances we have been seeing all year. But we are getting better with supply. So as soon as we can find balance there, it will certainly help boost the mood in the markets. But the thing to keep in mind is what inflation actually is and that’s the rate of change of prices. Not necessarily the level of prices, but the rate of change. Like running on a treadmill when you go from 1% to 2% that’s 100% “inflation”. But when you go from 2 to 3, that’s 50% and so on. Same idea here as we are beginning to level out and may already have. And one of the leading critics of Fed, Jeremy Siegel, is already saying inflation is over by referencing the sharp drop in housing. We shall see and next week’s Fed meeting will shed more light. In any case, expect a 50 bps hike. But the moral of the story here is you can’t have inflation come down without unemployment going up and this is the “soft landing” the Fed is trying to achieve.

- Manufacturing – this is, by far, the key cog in the supply demand dilemma and if manufacturing can turn itself around, we will again see better days ahead. But right now, we are nowhere near equilibrium with demand outweighing supply by a large margin. However in the latest ISM Manufacturing report released last week, it was nice to see only one reference to the phrase “supply chain” in the respondents’ comments and it even wasn’t a negative reference either where Transportation Equipment said “Supply chain issues persist, with minimal direct effect on output.” It was also nice to see backorders down and supplier deliveries up.

- Housing – simple supply and demand here but we are seeing a double whammy on the demand side as people are not buying homes as mortgage rates have spiked in the wake of the Fed’s tightening policy and owners are simply staying put with their low-rate mortgages. Another interesting thing right now is the spread between a 30-year mortgage and the 10-year treasury is abnormally high these days. That infers it might come down which means mortgage rates could also possibly come down. This article discusses that and estimates mortgages could be in the 5% range next year. Versus 7% now.

- Oil – And last but not least, we have oil which is a textbook example of supply and demand. Simply put we have way more demand out there than there is supply in the oil markets and that has caused huge price hikes in the price of gas which we have all seen at the pump. And other sources of energy, like natural gas. Couple that with an energy crisis overseas due to the war in Ukraine and the strategic petroleum reserves at historic lows after releases this year and we have a huge imbalance. This will take time to come back into equilibrium.

All of these factors (and more) play a key role in the supply demand equation which the market is grappling with right now. Any imbalance leads to uncertainty and obviously we have a lot of that right now. Which is leading to continued volatility in the markets.

In other news this week, CNBC put out a great article on what America’s top CEOs are saying about what could happen next year. In a nutshell:

- JP Morgan – Jamie Dimon has been vocal all year about a “hurricane” coming our way and has not backed off that theme. He is calling for a recession. And coincidentally, I attended a dinner event with JP Morgan this past Tuesday where their CIO and Head of Global Fixed Income Bob Michele, CFA spoke. He too painted a gloomy outlook saying recession by mid-year next year. He also highlighted that the rolling 3-month annualized inflation rate right now is 5.7% which is well above where the Fed historically pauses (at 4%) or when they cut (3%). So, he is simply saying the Fed has more work to do and will most likely hike us into a recession. He talks about this and more on fixed income in this recent “Insights Now” chat with Dr. Kelly on Dec 1.

- GM – Mary Barra is not quite on board with a full-fledged recession but does see headwinds next year. However, she is saying they are seeing a very strong consumer right now. But they are proceeding with caution and see a “fairly conservative 2023”.

- Walmart – Doug McMillion doesn’t want a recession but sees it as a “necessary evil” to help cure inflation. He said they continue to see strong spending though (which makes sense as consumers flock to the staple products Walmart offers in groceries and household necessities). But they are starting to see more conservative spending in areas like electronics and toys.

- United Airlines – Scott Kirby is sensing a “mild recession” but has seen an uptick in business travel but did say traveler demand is plateauing which could indicate a recessionary signal. He also said they are still not out of the woods yet with pilot shortage and expensive fuel.

- Union Pacific – this is a key part of our economy in terms of shipping and logistics and CEO Lance Fritz said that part of their business is slowing down right now. He also made reference to the housing market and how parcel packaging has slowed down, saying the Fed is hurting demand and that’s “not good”.

The above theoretical and “real world” examples simply show that there is quite a bit of supply/demand imbalance out there right now and concerns around that continue to linger. Looking ahead, I am in the same boat here on an expected slowdown mainly because of what the Fed is doing but also because of the imbalances we are seeing. But I am not necessarily on the same page of a “hard landing” because I don’t think the Fed would set us up like that. Plus, I think the continued recovery we are seeing in supply chain will help alleviate further downside pressure on the inflation front. But I do think we are heading into a slowdown period. Which will affect earnings and bring more volatility (earnings estimates are already coming down). But basically, the ball is in the Fed’s court right now. We will hear more from them next week.

As far as what to do investment-wise, this doesn’t mean to run for the hills. Instead, we should invest smartly in asset classes and sectors that make the most sense right now. For example, in fixed income stay away from low-quality bonds which could see defaults if a recession were to happen. On the equity side, continue to focus on defense and quality. Like dividend stocks. These are trades we are considering with the team right now to add more exposure to that quality theme. On both sides of the model allocations. And, as always, we will stay uncorrelated across the board as much as we can with a focus on as much low beta and low duration risk as possible.

As with anything in life, equilibrium and balance are key. It’s no different in the markets and if we can get there in the year ahead, we will see the light!

Have a great weekend!

*all data sourced from Yahoo Finance as of the close on the date indicated.

Disclosures

- The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

- There is no assurance that any products or strategies discussed are suitable for all investors or will yield positive outcomes. Any economic forecasts set forth in this note may not develop as predicted.

- All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Alternative investments may not be suitable for all investors and should be considered as an investment for the risk capital portion of the investor’s portfolio. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

- Securities offered through LPL Financial, member FINRA/SIPC. Investment advice offered through Great Valley Advisor Group, a registered investment advisor and separate entity from LPL Financial.

Tracking#: 1-05351250