Last week, I attended a seminar hosted by SPDR funds on campus at The Kellogg School of Management at Northwestern University just outside of Chicago. It was so nice to be back in the world of academia. Our group actually stayed on campus in a “dorm for professionals”. It wasn’t 5-star luxury but it was nicer than what I remember college dorms to be back when I was in school. The highlight for me: no TVs in the rooms! That really brought me back to my college days. Anyway, with that I thought I would turn to what academics are saying about the markets right now. Below are three academics whose insights and commentary I follow and incorporate into the team discussions and decisions we have and make in the GVA Asset Management models.

- Jeremy Siegel, Ph.D., Professor, Finance, Wharton, University of Pennsylvania – Professor Siegel has been pounding the table all year that the Fed is way behind the eight ball, and they should have been raising rates way before inflation got out of control. He was on CNBC just yesterday with the same message pointing out 3 key areas of the economy he says the Fed should have known better: commodities, housing and money supply. Because all three were signaling inflation way before it ever showed up and if the Fed were to simply have looked at those trends maybe we would not be in the position we are now. He also said yesterday the economy could go into a depression if the Fed continues to try to get to 2%. That’s a pretty strong comment. His latest weekly commentary is here where he explains the market may struggle to make progress from here as the Fed remains aggressive.

- Richard Thaler, Professor, Behavioral Science and Economics, University of Chicago Booth School of Business, Nobel Prize in Economics – Professor Thaler came out publicly back in August saying he sees no signs of a recession. Especially in light of the current jobs market where there are more jobs available than people working. Which is leading to wage inflation which he says is a good thing (and makes sense). From a behavioral aspect though, he says people have difficulty with a new problem. i.e. high inflation right now. That’s an interesting point as well and also makes sense if you put yourself in the shoes of the Fed during this historic time. Or even the consumer as they continue to see elevated prices everywhere without any way of knowing when they will eventually come down. Speaking of which, Thaler actually does contemplate a possible deflationary environment a year from now assuming the war in Ukraine ends and China comes out of Zero Covid. Which could very well happen if either scenario plays out.

- Aswath Damodaran, Ph.D., Professor, Finance, NYU Stern School of Business – he publishes a blog here, and in his latest comments, he warns that people may be in for a rude awakening if they are looking at inflation right now like it was the 1970s. Because if they are expecting inflation to peak over the next year and then subside, he is saying that could be “hopeful thinking”. He also said that stocks are “very mildly overvalued” at this time, and he is not quite ready to jump in and make bets on the market right now. He also raises a key point from fundamental theory which is “expected inflation” and says that is the reason why inflation continues to go up – because the market expects it to.

Each of these insights are of course at a very high level and simplified but they do hit home that, at least for these three academics, there is a collective concern about what’s going on out there right now. And that inflation may be a sticky point for longer than people think. Which could lead to a slower economy and more volatility. This helps paint the picture of what we at GVA have been saying and doing in the models this year by staying conservative and allocating to defense and quality.

In other market news this week, we saw a few key headlines cross the tape:

- More of the same – inflation remains hot – on Thursday we got the latest reading on CPI for September which again was near all-time highs with y/y up +8.2%. Food and shelter were again big contributors and services continue to stay hot as well. This inflation data does not seem to be slowing down anytime soon. We do expect to see continued higher inflation for the foreseeable future because there is a lag between what the Fed is doing and inflation eventually coming down.

- Jamie Dimon warns of a recession in 6-9 months – he came out earlier this week saying the S&P 500 could fall by another 20%. This is after he came out back in June saying he was preparing JP Morgan for an economic “hurricane” caused by the war and the Fed. Not a very rosy outlook from the JPM CEO.

- Netflix to add a $6.99 tier with advertising – this is $1 less than Disney and Hulu with commercials so this was welcome news by the market. The stop jumped 5%. We hold the company in the GVA models and it has been gaining momentum with recent shows like “Stranger Things”.

- UK bond market rallied on news of budget reversal – Europe rallied amid rumors the UK government is preparing to backtrack on some of the unfunded tax cuts in the mini-budget. Perhaps this will give some relief to the European markets which are on the verge of recession as central banks continue to tighten over there.

It sometimes helps to go back to your academic roots to make sense of things. In a way, this market has made things pretty confusing for a lot of people – academics and top brass included. But academia is rooted in theory and fundamentals. Hopefully, the market will eventually root itself in these concepts as well and sense will come back to order. Maybe it will start with earnings which we will be seeing a flurry of companies reporting over the next several weeks. Let’s see what the reports bring.

Thanks for reading and have a great weekend!

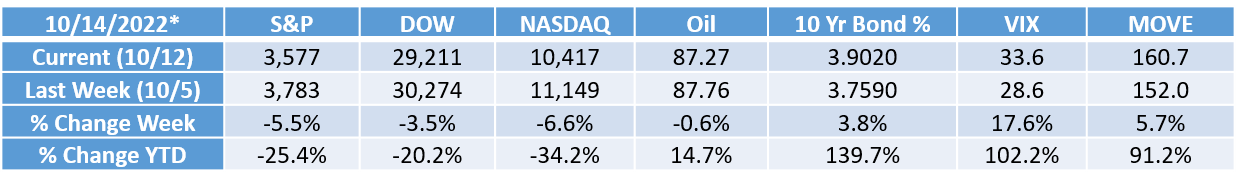

*all data sourced from Yahoo Finance as of the close on the date indicated.

Disclosures

- The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

- There is no assurance that any products or strategies discussed are suitable for all investors or will yield positive outcomes. Any economic forecasts set forth in this note may not develop as predicted.

- All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy.

Tracking#: 1-05338655